1️⃣Investment idea of the week

2️⃣Charts of the Week

This week, markets once again reminded investors that uncertainty remains the only constant. Heightened geopolitical tensions between the United States and Iran have added a fresh layer of risk to an already fragile macro environment, specially in oil 🛢️📈. WTI futures are trading at $66.48 per barrel , a level that suggests the market is pricing a moderate geopolitical risk premium, but not a full-blown supply shock. Brent is also holding at higher levels than WTI, consistent with a cautious risk backdrop tied to Middle East friction 🌍⚠️.

Source: markets.businessinsider.com

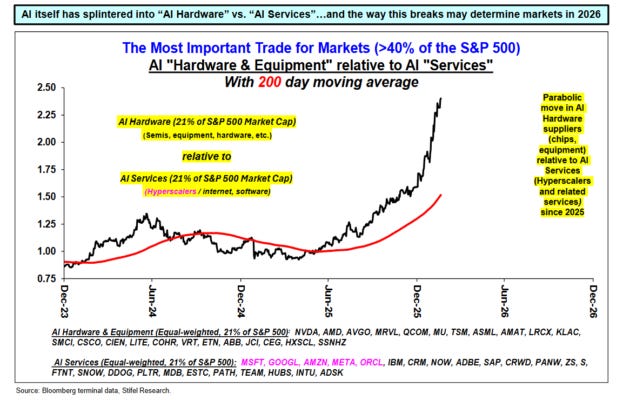

Redarding the economic data, it continues to send mixed signals and valuations remain demanding, the internal structure of the market tells a much clearer story. The real driver right now is the divergence inside the AI trade. 🔎📊

The first image shows a clear parabolic move in AI Hardware relative to AI Services since 2025. Hardware suppliers, chips and equipment are outperforming sharply, driven by massive capex from hyperscalers. Meanwhile, AI Services lag because monetization is not keeping pace with investment. There is heavy capital expenditure, but revenue realization is slower. 💰⚙️

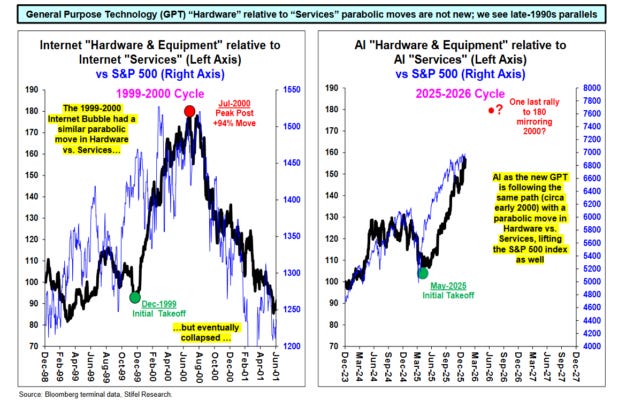

The second image connects this to history. In the late 1990s, Internet Hardware also surged relative to Internet Services. That relative outperformance peaked around 2000, before the collapse. The pattern was the same: infrastructure rallied first, services lagged, and the broader index followed the hardware boom higher before reversing. 📈📉

Today, we see a similar structure. The chart explicitly highlights a “parabolic move” in AI Hardware versus Services and even questions whether 2025 to 2026 could mirror 2000. The key element is the timing gap. Infrastructure spending accelerates immediately, but monetization takes longer. That lag creates distortions in valuations and expectations. ⏳⚠️

In short, both images tell one coherent story. First comes the buildout phase. Hardware leads. Services absorb costs. Then the market demands proof of returns. In 2000, that gap closed abruptly. Today, the same dynamic is forming again. The risk is the mismatch between capex and monetization.

3️⃣Articles of the Week

As usual, here are a couple of articles I found particularly interesting and constructive.

Christian Schmidt | @tridentopportunities

• Strategic reset thesis. The article argues Ampco-Pittsburgh has transformed itself by exiting loss-making businesses, simplifying operations and positioning for much improved profitability as EBITDA removes major drags.

• Catalysts ahead. It highlights that the remaining core segments, especially engineered products and Air & Liquid Processing, are structurally resilient and stand to benefit from industry dynamics and higher utilization, suggesting upside not yet priced in.

Robin Ghosh | @robinresearch

The article: presents CTT Systems as a small-cap aviation supplier mispriced by the market, arguing that temporary weakness masks a structurally attractive long-term setup.

Earnings setup: It walks through how recent softness was driven by short-term factors, while production ramp-ups and recurring revenue could drive a meaningful earnings rebound over the next two years.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.