1️⃣Investment idea of the week

2️⃣Charts of the Week

Markets remain clouded by elevated uncertainty, and capital continues to rotate defensively, moving away from crowded growth exposures toward safer assets and traditional hedges such as gold. 🛡️📉

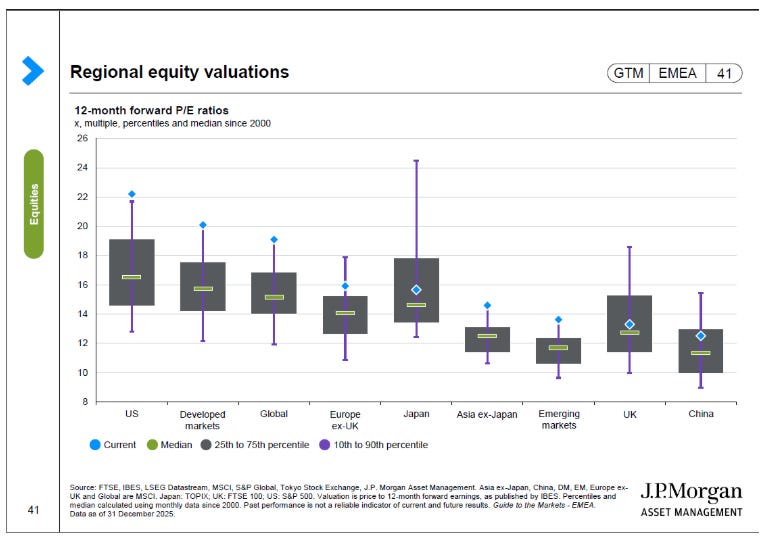

This valuation chart reinforce this context. On a 12-month forward P/E basis, the U.S. trades toward the upper end of its historical range, while several international and emerging markets sit closer to or below long-term medians. These charts do not predict outcomes, but they highlight a key point: relative valuations matter, and the U.S. is no longer inexpensive. 📊⚖️

At the same time, we should keep in mind that the long-term dominance of U.S. equities over international markets has lasted more than a decade however by the same logic history reminds us that leadership rotates.

There have been prolonged periods when international markets outperformed, and today’s U.S. dominance should not be seen as permanent or guaranteed for the decades ahead.. ⏳🌍

3️⃣Articles of the Week

Here are a couple of articles I found particularly interesting and constructive.

AltayCap | @altaycap

Mispriced as a cyclical graphite producer ,not an aerospace asset. The market values Nippon Carbon as a mature industrial, overlooking its strategic stake in a GE/Safran JV supplying critical SiC fibers for next-generation aircraft engines.

Asset-backed downside, aerospace-driven upside. Trading near book value with balance sheet support, the company offers asymmetric re-rating potential if aerospace production ramps and industrial demand normalizes.

a16z | @a16z

AI doesn’t kill software , it multiplies it. The article argues that easier software creation (via AI) increases supply and demand, expanding the surface area of what gets built rather than shrinking the industry.

Tech shifts expand markets, not erase them. Just as past platform transitions created more software and new winners, AI changes the form factor and builders — but strengthens software’s central role in the economy.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.