1️⃣Investment idea of the week

2️⃣Charts of the Week

This week has been marked by a sharp correction in gold and silver, following one of the most extended and vertical bull phases in modern history. What initially looks like a sudden pullback is, in reality, the natural consequence of extreme positioning, elevated confidence, and excessive leverage accumulated over time.⏳📉

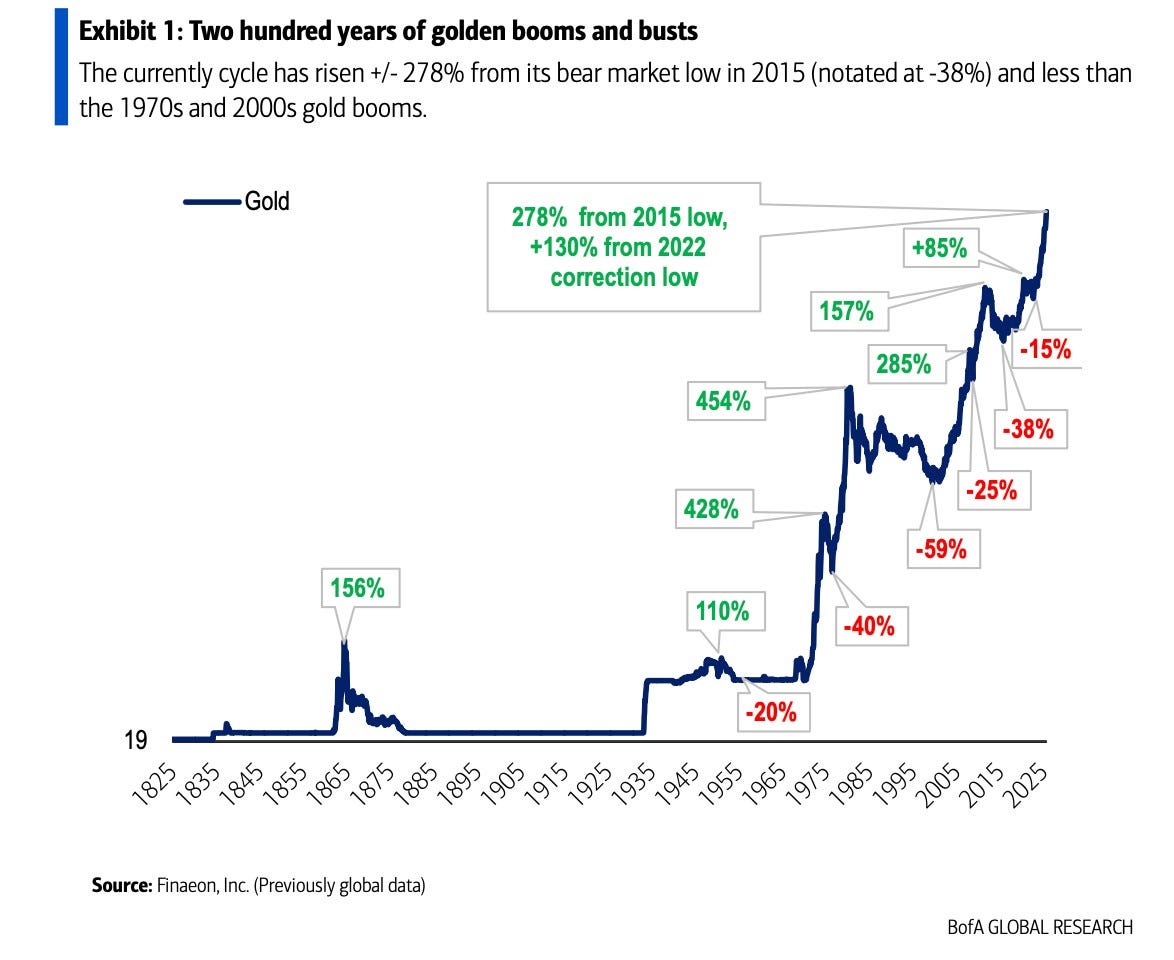

As we can see in the first image, gold’s long-term history shows that major bull markets have consistently been accompanied by deep and abrupt corrections once positioning becomes crowded. The current cycle, with prices up approximately +278% from the 2015 lows and more than +130% since the 2022 correction, clearly fits this late-stage pattern. At such advanced levels, even minor catalysts can trigger rapid deleveraging events.

In the second image, we observe the key factor that amplified the sell-off: a severe lack of downside protection. The CBOE Equity Put/Call Ratio near 0.58 highlights a market heavily tilted toward calls, signaling high directional exposure and minimal hedging. When prices started to fall, investors had little protection to monetize, forcing them to sell the underlying assets directly and accelerating the decline. 📊⚠️

Finally, the last image reinforces this diagnosis, showing bubble-like dynamics in precious metals compared to other asset classes. This aligns with institutional data indicating historically low hedge levels, as confirmed by recent global fund manager surveys.

In summary, this was not a fundamental breakdown, but a classic late-cycle correction driven by complacency, crowded positioning, and insufficient hedging. Such moves tend to be fast, violent, and mechanical, reminding investors that even defensive assets are vulnerable when positioning becomes extreme.🛡️❌

3️⃣Articles of the Week

As every week, here there are a couple of articles that we found particularly interesting and constructive.

Christian Schmidt | @tridentopportunities

Explains a turnaround driven by structural simplification, where exiting loss-making operations unlocks EBITDA and cash flow.

Shows underappreciated industrial exposure to long-cycle demand, creating upside not yet reflected in the stock’s valuation.

Giles Capital | @gilescapital

Explains how increasing market dispersion is reviving value opportunities, combining disciplined stock selection with macro awareness to identify mispriced assets.

Shows concrete investment ideas with catalysts and downside protection, focusing on valuation gaps rather than narrative-driven trades.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.