1️⃣Investment idea of the week

The market still values Water Intelligence plc ( $WATR ) as a small water services company. Quietly, it is becoming a more scalable business with revenue recurrence, long-term partnerships and healthy balance sheet. 💧🛠️

Would you own this business for the next 5 years? Why not?⏳📈

Please, let us know in the comments.👇

2️⃣Charts of the Week

This week was marked by a continuation of the same underlying trend that has defined markets for years: U.S. equities, and especially U.S. Tech, continue to do the heavy lifting. As the first chart shows, returns since 2006 remain overwhelmingly concentrated in U.S. Tech, while Europe, emerging markets and the U.S. market excluding tech lag significantly behind. As usual and everybody hilights; only a narrow part of it is really driving returns. 📈

Source: Goldman Sachs via Daily Chartbook

As you noticed, when we strip out technology, the picture becomes less convincing. U.S. equities ex-Tech look far closer to the rest of the world, highlighting how dependent recent performance has been on a small group of mega-cap winners.

This raises an important point for investors: headline index strength can mask growing fragility underneath, especially if expectations around growth and margins begin to slip. ⚠️📊

Source: @Charliebilello / X

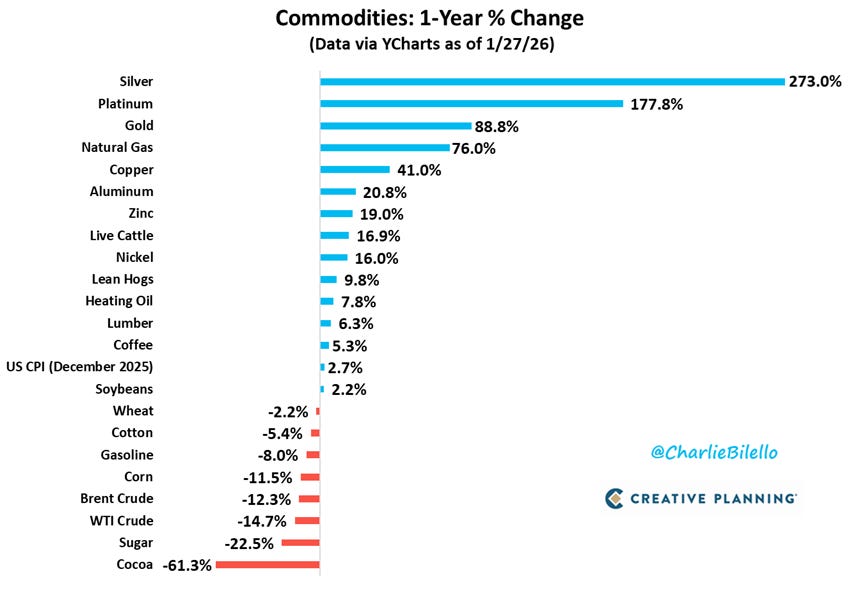

At the same time, risk is quietly being repriced elsewhere. As shown in the second chart, precious metals have surged over the past year, with silver, platinum and gold clearly standing out. This is not a broad commodity boom. Instead, it reflects rising geopolitical uncertainty, demand for hard assets, and early hedging against financial and currency risks. 🪙🌍

Certainly, the sharp move into metals suggests caution rather than euphoria. For now, markets remain constructive, but the balance between confidence and risk is becoming more delicate. ⏳🔍

3️⃣Articles of the Week

As usual, there are a couple of articles that we found particularly interesting and constructive.

Sergey | @sergeycyw

Reviews recent earnings to assess how AI investment is impacting business performance, beyond headline results.

Highlights increasing dispersion across companies, with software platforms benefiting from recurring revenues and pricing power.

Inversión Independiente 📊 | @inversionindependiente

Presents a list of airport-related stocks, focusing on infrastructure operators with long-term traffic growth, pricing power and regulated cash flows.

Explain airports as resilient, asset-heavy businesses, benefiting from post-pandemic travel normalization, inflation-linked revenues and high barriers to entry.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.

Thank you for sharing 👍