1️⃣Investment idea of the week

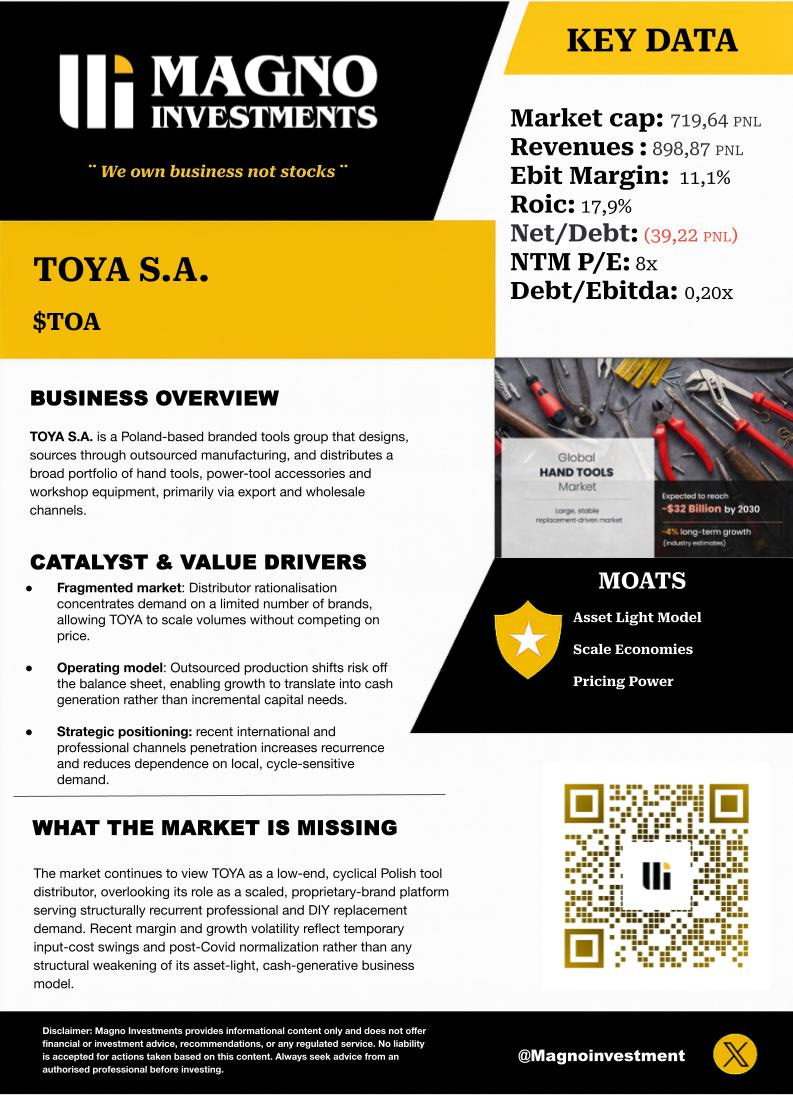

The market sees TOYA S.A. ($TOA) as a cyclical, low-end Polish tools distributor. Quietly, it is expanding its professional and international footprint. 🛠️🌍

Would you be comfortable owning this business for the next 10 years? ⏳📈

Do you hold this company in your portfolio already?

Please, let us know in the comments.👇

2️⃣Charts of the Week

This week’s market narrative has been shaped again by the called “Taco trade” headlines, derived from Greenland negotiations to revived tariff rhetoric.🌍📉

It reinforces how quickly geopolitical noise can resurface even in risk-on markets, and how rapidly underlying conditions can shift. ⚠️

How is the market positioned amid all of this? 🤔📊

This chart shows global fund managers’ cash levels at a record low of ~3.3%, indicating portfolios are nearly fully invested.

Historically, such extremes have coincided with crowded positioning, limited incremental buying power, and weaker short-term equity returns, as liquidity buffers all but disappear.

On the other hand, and impresively, this picture shows us that, despite elevated valuations and macro uncertainty, most managers have not put on downside protection.🛡️❌

Hedging activity sits near cycle lows, signalling complacency and leaving portfolios exposed to abrupt drawdowns.

Together, these charts depict a market that is fully deployed and largely unprotected , highly dependent on continued benign conditions, and increasingly vulnerable to negative surprises.🎯💥

3️⃣Articles of the Week

As usual, there are a couple of articles that we found particularly interesting and constructive.

Kairos Research | @kairosresearch

Reframes ContextLogic as a capital allocation platform underpinned by substantial NOLs, rather than a failed e-commerce asset.

The investment case hinges on disciplined redeployment of excess cash into cash-generative assets, with tax shields enhancing long-term FCF per share.

HatedMoats | @hatedmoats

Positions Mo-Bruk as a regulated waste treatment business with structural entry barriers and durable cash flow visibility.

Argues the market is over-penalising one-off accounting adjustments, overlooking resilient margins and long-term FCF compounding potential.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.