1️⃣Investment idea of the week

What if short-term noise is masking long-term value❓

Thermador Groupe ( $ THEP ) has seen growth slow but its surface lies a resilient, cash-generative, asset-light business quietly upgrading its industrial mix.🛠️📊

What do you think? Would you invest in this company?

Do you hold this company in your portfolio already?

Please, let us know in the comments.👇

2️⃣Charts of the Week

This week opens with U.S. equities holding near highs, but the underlying signals suggest a market that is increasingly priced for perfection. While headline indices remain supported by a narrow group of large-cap leaders, sentiment ( 7 magnificent) positioning and fund flows are flashing warnings that forward returns may become more and more asymmetric.🧲📊

The key message going into this week is not one of imminent downside, but of fragility. Investor confidence has risen rapidly, yet capital allocation patterns reveal a growing reluctance to embrace broad-based risk. This tension between optimistic sentiment and defensive behavior is the defining feature of the current market setup.

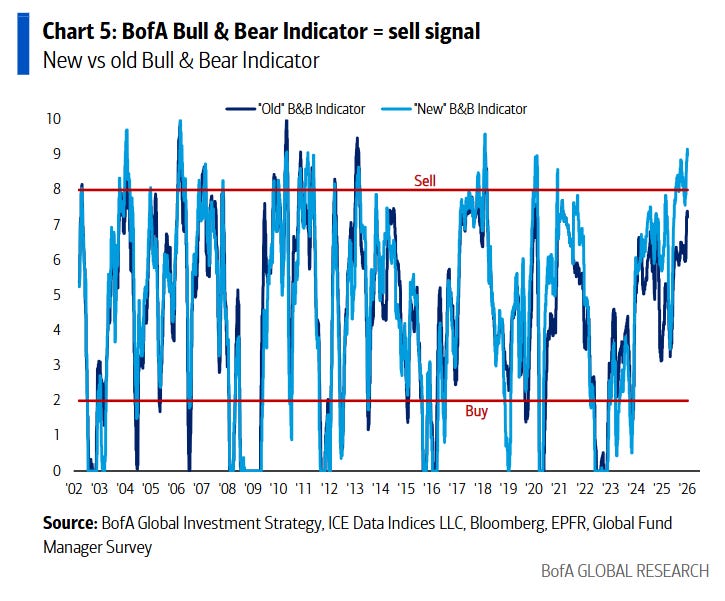

The Bull & Bear Indicator has moved decisively into sell territory, highlighting an increasingly crowded long positioning. Historically, such sentiment extremes have coincided with lower forward returns and rising volatility, suggesting that upside from here may be more limited unless fundamentals re-accelerate. Importantly, this reflects positioning and optimism rather than stress, leaving markets more exposed to possible disappointments. 🧠⚠️

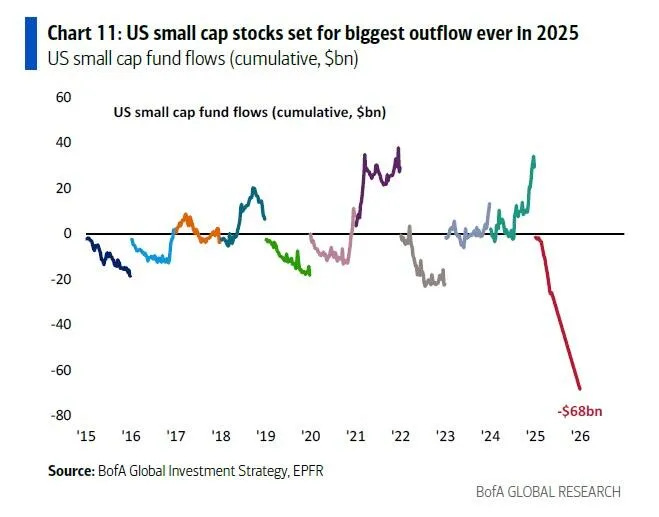

In contrast to elevated sentiment, US small cap funds are experiencing record outflows, pointing to broad-based derisking rather than incremental rotation. While this weighs on near-term small cap performance, flows of this magnitude have often marked late-cycle risk reduction phases, as investors retreat toward liquidity and balance sheet strength. Historically, such extremes can eventually set the stage for selective mean reversion once macro uncertainty stabilizes.🔄🧭

Putting both charts together, the message is clear: confidence at the index level is masking growing internal strain. Sentiment is stretched, participation is narrowing, and capital is becoming more selective. Markets can remain elevated under these conditions, but returns tend to become harder-earned and volatility less forgiving.

3️⃣Articles of the Week

Below are a couple of articles that we found particularly insightful and constructive.

AmsterdamStocks | @amsterdamstocks

Analyzes Gullewa as a high-margin gold royalty business with stable cash flows and significant valuation upside.

Highlights asymmetric returns driven by royalty income, conservative balance sheet, and leverage to higher gold prices.

Jakub Kreuzmann | @ideasbykreuzmann

Explores how founder passion, strong culture, and disciplined capital allocation can translate into superior long-term investment returns.

Focuses on identifying high-quality growth businesses where intrinsic value compounds through execution and management alignment.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.