Hello everyone!

I hope you had a great week.

In order to improve the newsletter, we have introduced a new section where we share some of the most interesting investment ideas we came across.

From now on, you will also receive an investment case highlighting the key insights behind the analysed company.🧠📊

See the first edition below. 👇

1️⃣Investment idea of the week

2️⃣Charts of the Week

What can we expect from the 2026 beginning?

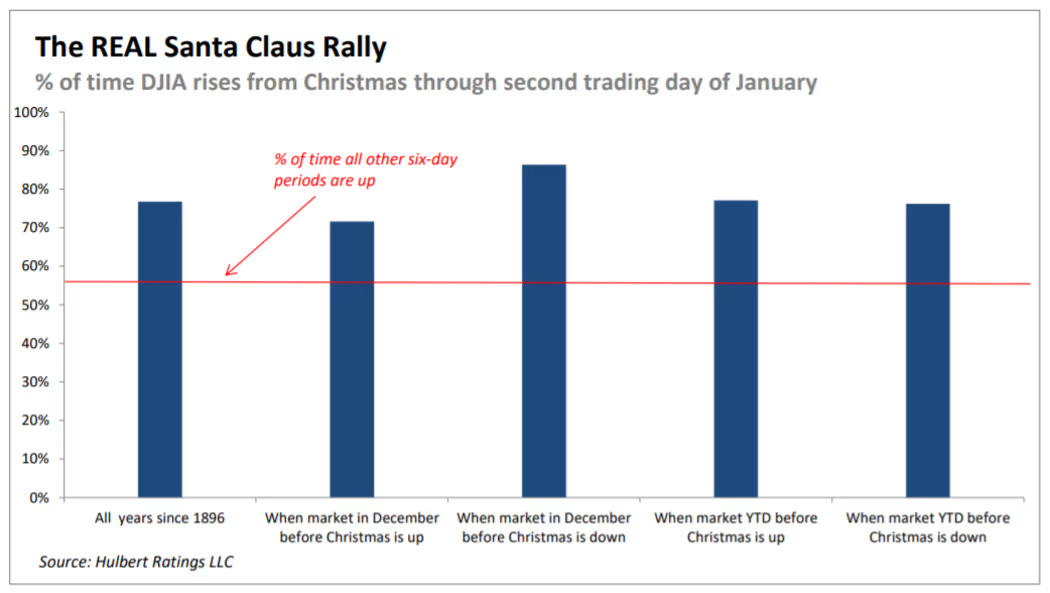

This chart highlights the historical tendency for U.S. equities to post positive returns during the so-called Santa Claus Rally period, defined as the days from Christmas through the second trading session of January.

The shown chart suggests that this short window has delivered positive returns significantly more often than other comparable periods, regardless of prior market performance. While not a trading signal, it highlights the impact of seasonal positioning and year-end sentiment.

According to daily closing data from the Federal Reserve Bank of St. Louis (FRED), the Dow Jones Industrial Average (DJIA) has climbed from approximately 48,382 at the close of January 2, 2026 to about 49,266 on January 8, 2026. 🏦⚖️

That implies a gain of roughly:

~1.8%–2.4% in the first week of trading in 2026

However, this is not an extreme Santa Claus Rally we can say that it’s a positive, constructive early-year advance.

What follows?

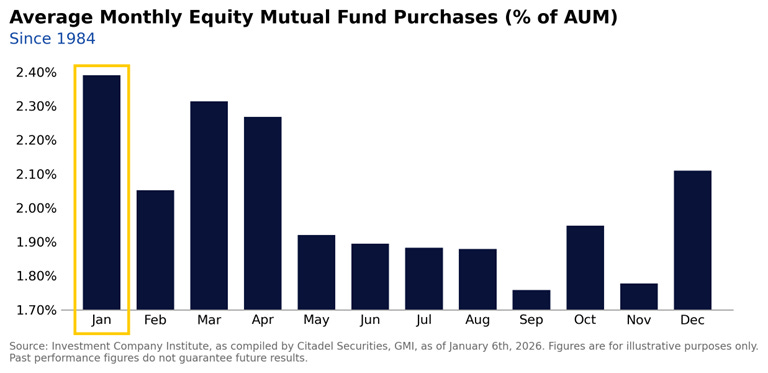

On the other hand, the second chart shows average monthly equity mutual fund purchases as a percentage of assets under management since 1984, revealing a clear and persistent seasonal pattern in investor behavior.

The chart shows that January remains the strongest month for equity fund inflows, and this pattern is once again playing out at the start of the year.📈

For instance, the S&P 500 has climbed about +1.1 % in 2026 so far, reflecting a constructive start to the year. This aligns with the positive early-year seasonal tendency suggested by historical patterns. However, taking both charts into account, it remains too early to conclude the emergence of a sustained rally.⏳

3️⃣Articles of the Week

Below are a couple of articles that we found particularly insightful and constructive.

James Emanuel | @rockandturner

Explores Fairfax India as a possible long-term vehicle for accessing India’s structural growth through high-quality infrastructure assets.

Highlights valuation upside and patient capital catalysts, focusing on compounding over time.

The AI Architect | @theaiarchitects

Argues that the next AI cycle will be driven by inference demand, power availability and also data-centre infrastructure.

Positions IREN as a potential beneficiary due to its scalable, energy-backed compute capacity.

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.

thanks for the mention