Welcome to the first edition of our Weekly Investment Newsletter;

From now on, every Sunday you will receive a concise and structured overview of the key macroeconomic trends and global market dynamics💼📈

Our focus will be on fundamentals, tools, content, and real economic drivers that ultimately create sustained long-term value. 🏦🌍

This newsletter is designed to support you in making clearer, more confident and more deliberate investment decisions at the start of each week. 🧠⏳

1️⃣ 2025 End-Market Summary

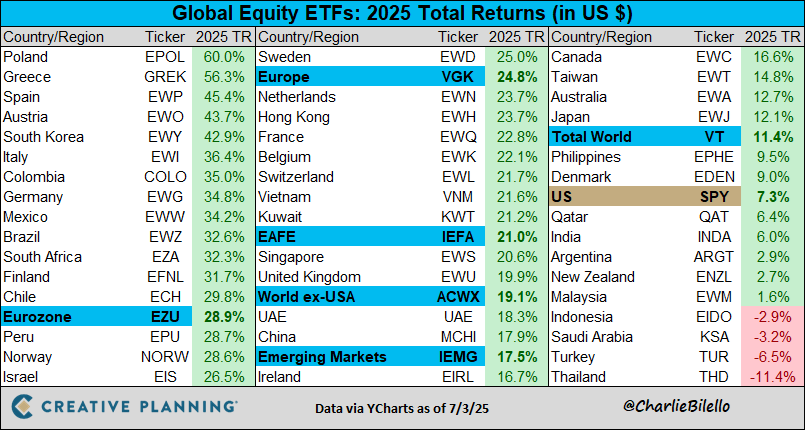

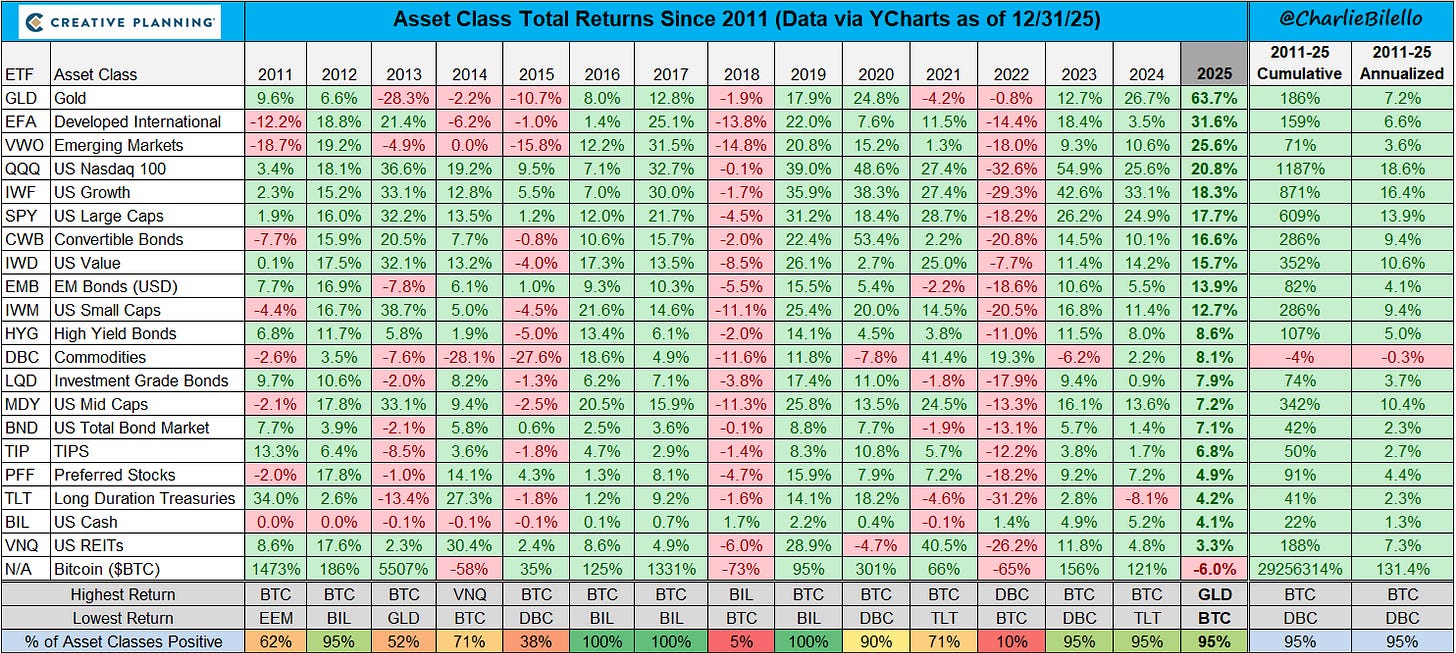

This year was marked by a clear shift in leadership across markets and asset classes, reinforcing the importance of diversification and global exposure. Performance patterns highlighted both cyclical rotation and long-term structural trends.

Equity returns were highly dispersed, with Europe and several emerging markets strongly outperforming, while the US lagged behind. The year clearly reflected a rotation away from US-centric leadership.

Over the long term, risk assetsparticularly US equities whic remain dominant, but 2025 illustrates how leadership rotates across cycles. Short-term outcomes can differ meaningfully from long-term winners.

2️⃣Charts of the Week

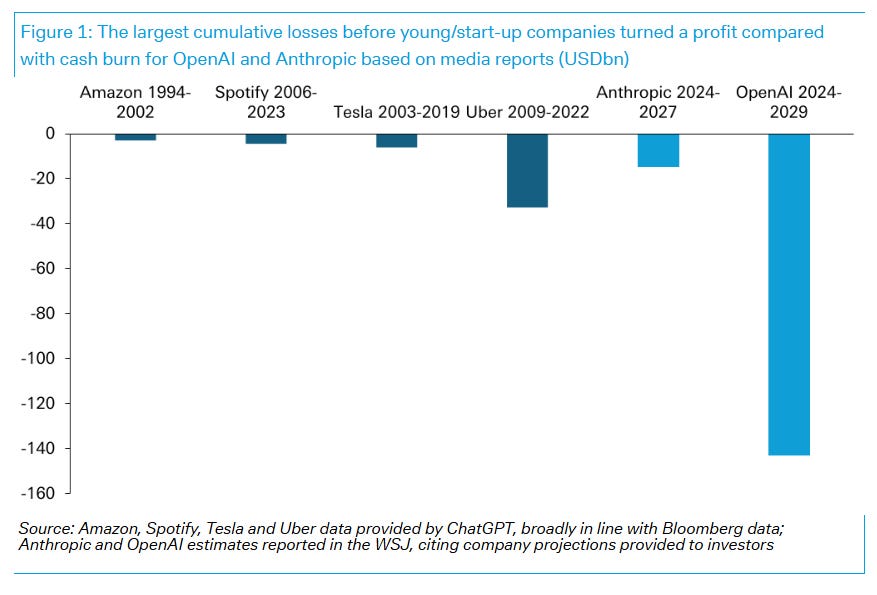

Cumulative Losses Before Profitability – Big Tech vs AI Labs

The starting point is the nature of today’s growth engine. Unlike previous technology cycles, frontier AI development requires unprecedented upfront investment, with leading AI labs absorbing large and prolonged losses before reaching profitability. This extends largely the payback periods and raises the importance of funding conditions and long-term capital commitment.

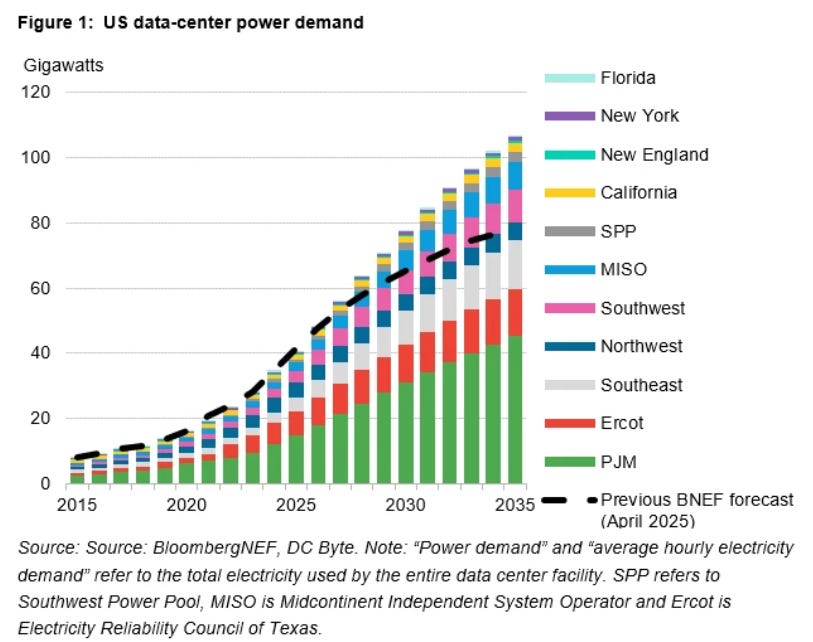

US Data-Center Power Demand Outlook

That capital intensity is not abstract as it translates directly into physical demand. The rapid expansion of AI and cloud infrastructure is driving a sharp increase in US data-center electricity consumption, turning energy availability and grid capacity into binding constraints on digital growth.

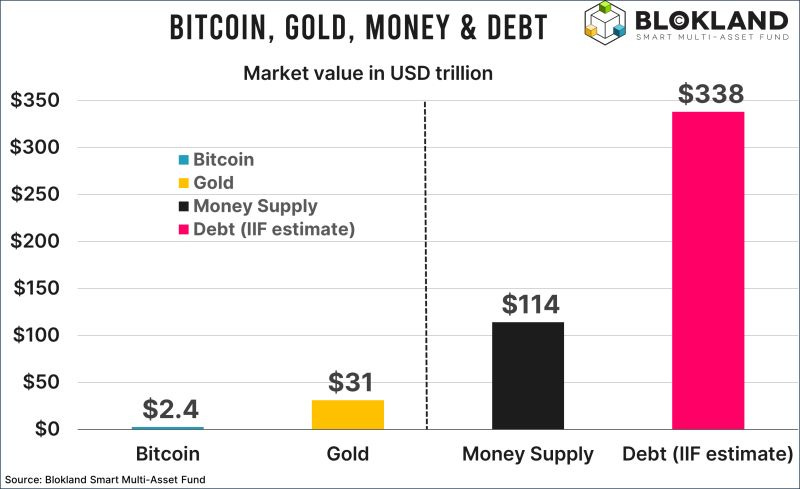

Bitcoin, Gold, Money & Debt (Market Value, USD tn)

On the other hand, this chart provides scale and context: even transformative assets remain small compared with global money supply and, especially, global debt. In a cycle defined by heavy AI investment and rising infrastructure demand, this level of leverage means growth expectations matter more because in a highly indebted system, disappointment can be huge amplified.

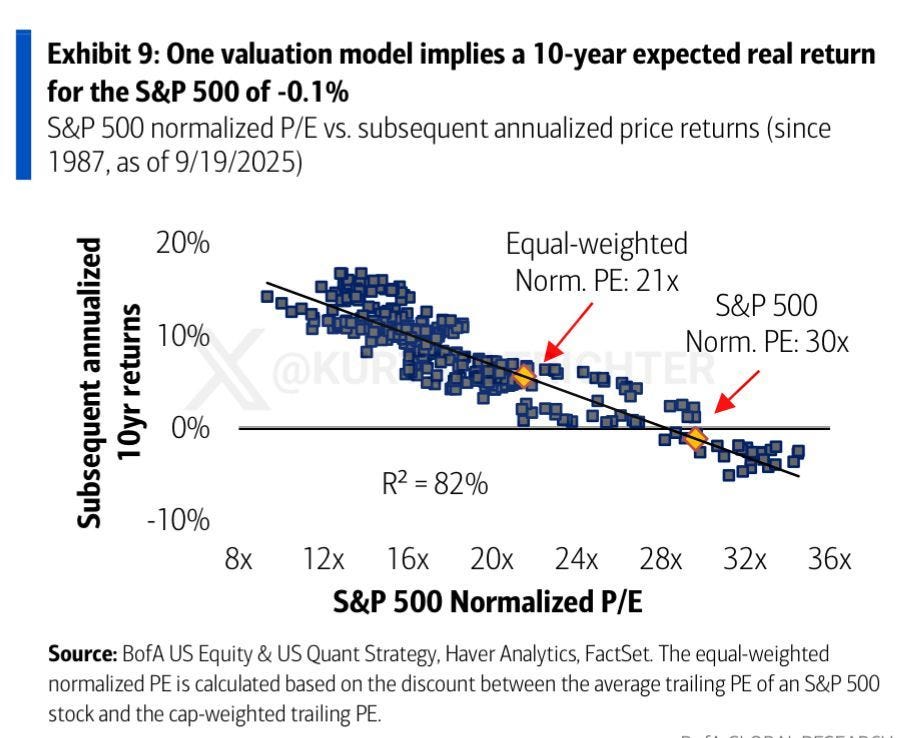

S&P 500 Valuations vs Future Real Returns

And what about the current valuation? A system rich in capital and optimism has pushed equity multiples to elevated levels, and history shows that high starting valuations tend to compress long-term real returns. The growth story may persist, but the margin for error narrows as expectations rise.

Conclusion

All the provided information leads us to know that the challenge ahead is not a lack of growth, but its cost and its price. In a world of capital-hungry innovation, real-world constraints, and stretched valuations, future returns are likely to depend less on market direction and more on selectivity, discipline, and realistic assumptions.

3️⃣Video of the Week

I am big fan of this youtube channel, here one of his last videos:

You’re Not Going to Predict the Next Market Crash

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments does not represent a financial advisory service or investment service. All information provided and given by Magno Investments is of an educational and informative nature and in no case implies any kind of recommendation to buy or sell any securities. Carlos Chaume and Magno Investments Research are not responsible for the use made of this information or the veracity of its sources. Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it.

The S&P 500 valuation vs future returns chart is the brutal reality check everyone needs but few want to see. I watched a portfolio manager at a conference last year completely dodge this relationship when somone asked about entry points, kept pushing "time in the market" without acknowledging that starting valuations matter hugely for decade-level outcomes. The energy grid constraint angle on AI scaling is underappreciated too.