Undervalued European Stocks Opportunity // Global Market Crash & Tariff War (2025)

European Companies are Extremely Undervalued.

Hello everyone and welcome back to magno investments!😀

Due to current geopolitical conflicts and political changes, stock markets are facing several drawdowns and the worldwide economy is struggling.

Many investors have seen their portfolios down during these months. The idea of higher inflation or even a recession has made the valuation of the companies fluctuate.📉🔍

Today we are going to analyze the actual macroeconomic situation in order to understand and anticipate the different scenarios.

I have summarized the main existing Catalyst that could possibly enhance and boost the European economy.🚀📊

-European Growth & Recovery

Generally speaking, Europe had never had the same growth and market return in comparison with the USA; however we have to consider that there were occasions where the US stock market was likely not to perform well in many years. We can see how After the two thousand dot-com bubble, the SP ended up almost at the same level after 10 years.⏳📑

¨The Lost Decade¨

Source: Syfe

During the last years, there has been a general negativity in European stocks that has been promoted by the regulations that Europe was implanting and the low economic growth it was experimenting, that combined with the excellent USA market returns, made the institutional and retail investors look beyond the sea.🗽🌐

Source: Bloomberg

This feeling has been increased by the new president of the USA, Donald Trump, who threatened and imposed tariffs and taxes on many of the foreign products that the USA imports. Being Europe one of the main suppliers, the effect was immediately noticed in the European stock markets.

Certainly, the situation previously described made Europe attractive to seek value and find undervalued quality stocks.

Nowadays there is a vast universe of undervalued stocks out there where an investor with an edge can generate excellent returns outperforming the index or benchmark, therefore the average market return.

The major companies affected by this trend were especially the European small caps, which,as you probably know, are more exposed to the interest rates and economic downturns.

On the other hand at the same time small caps are more dynamic in order to adapt to the real economy.

Through history small caps have generated higher returns than other kinds of companies, moreover, small companies tend to be less covered by professionals and institutional investors, so those among investors with an edge can find bargains easily.💸🌍

Source: Investing.com

-USA Stock Market Valuation

The second reason to look European Stocks is the USA market valuation. Aswe can see the current s&p P/E valuation is above its average. That would not be a problem if the valuations were reasonably adjusted to the EPS of the companies and the the weight of the index were properly distributed among the companies listed.⚖️📝

Source: JP. Morgan

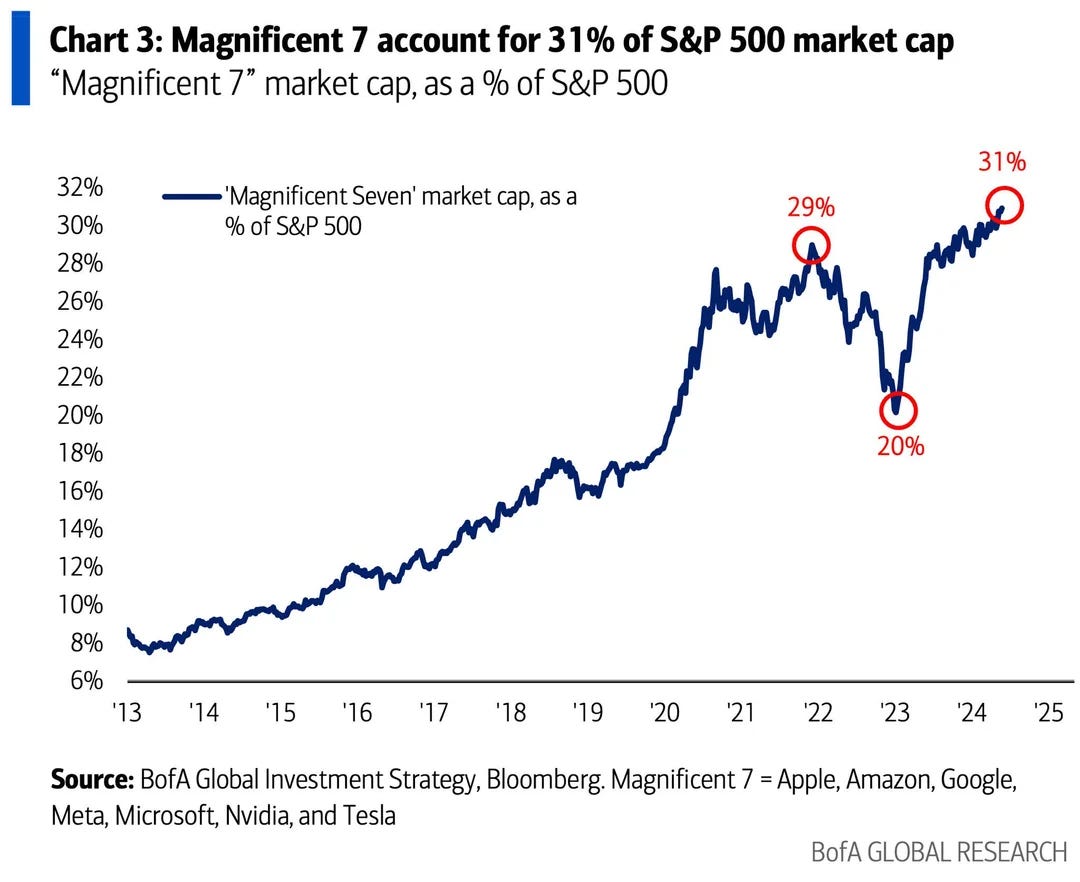

However, what the market calls as the ¨Seven Magnificent¨ reached almost 31% of all index value. That implies a huge concentration in a few stocks, which, as said, its high P/E ratios make it complicated to think that the relationship between risk/profit remains the same.

Source : Bank of Amercia

As a proof of this, here we can see how NVIDIA stock in some point became larger than the respective stock markets of Germany, France, and the U.K.

Source: Bloomberg FInance Lp, Deutsche Bank

All of this, combined with a weaker dollar and the deterioration of the economic and geopolitical decisions of the administration has produced a highly volatile investment climate that presents a substantial risk of loss, but also a fertile field of opportunities for many active, informed investors prepared to seek profits across markets and different asset classes.

Source: Bank of America

Actually, we can see how during these weeks, a huge amount of capital flowed from the USA market to European stocks.👔☕💼

Source: Bloomber, Macroband

There are other factors supporting this potential shift. One is relative valuation, the sharp rise in the US market (primarily boosted by the recent AI expectations) over the last years has made it more expensive compared with Europe.📰🏆

Source: Bank of America

Monetary policy has also played an important role. While the Federal Reserve has held back expectations of aggressive rate cuts due to the strength of the US economy, the European Central Bank has maintained a soft attitude about it, which has favored European markets.💹💸

-Geopolitical Conflicts

Finally, another aspect to mention is the geopolitical conflicts and their implications in the stock markets.

The possibility of ending the conflict in Ukraine will have a tremendous positive impact on those predictions, since the end of this situation is not discounted in the real economy.

Removing international sanctions and embargoes will improve international business and trade.🏗️🌍🏘️

Energy cost, lack of raw materials, and many logistic implications made the inflation rise through these years all over the world, especially in Europe. Ending the conflict will not only benefit the countries involved, but also the companies that have been affected and compromised in a direct or indirect way.

-Conclusion

As a conclusion, I would say that doing nothing and trying to predict the next stock market crash or the exact moment when market valuation is lower is an error.❌🧠📊

If we look back through history, these problems happened in a very similar way. What we can expect from the current situation is nothing more special than what people were expecting in the last economic crisis or stock market corrections.

Source: YCharts,

We assume that we are going to receive high return without no volatility

Here as an example of the different intra year- declines from 80´ to 2022 . As we can see declines of 5, 10 even 15% are quite normal.

Source: Facshet, JPmorgan.

Well, so where should we be invested, or what can we do to protect our capital?🧠🏛️💰

What you can do is stick to your personal strategy. No matter if Inflation rises or if we even face a deflationary scenario, you should be prepared for every possible change, so you will be able to adapt and take profit for every situation.

Source: T.Rowe Price

Personally, I think that we should be aware of the global changes, but if we have a very well diversified portfolio, and we really know what assets we are invested in, we will be able to navigate this situation without major problems.

Well, I hope you have enjoyed the content.

May the investment be with you!😃

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments does not represent a financial advisory service or investment service. All information provided and given by Magno Investments is of an educational and informative nature and in no case implies any kind of recommendation to buy or sell any securities. Carlos Chaume and Magno Investments are not responsible for the use made of this information or the veracity of its sources. Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do so.

Totally agree, there are many undervalued European companies due to the dominance of American companies in recent years, including some high-quality small caps. It's a hotspot for opportunities