Fund Overview

TROJAN FUND (IRELAND) – I ACC EURH is a flexible multi-asset UCITS strategy designed with a clear objective: deliver long-term capital growth above inflation while prioritising capital preservation. The fund explicitly targets returns ahead of the UK Retail Prices Index over a five to seven-year horizon, anchoring its mandate in real purchasing power protection rather than benchmark-relative performance.

ISIN (Class I EUR Accumulation): IE00BYV18N80

Structure: UCITS (Ireland-domiciled)

Investment Manager: Troy Asset Management Limited

Asset Class: Flexible Multi-Asset

Currency of the analysed share class: EUR

Fund launch date: 2012

Share class launch date: 2016

This Class I EUR Accumulation share class is denominated in EUR and structured for long-term investors seeking disciplined risk management and multi-asset diversification within a single vehicle. From inception, the philosophy has remained consistent: avoid permanent capital loss first, compound steadily second. 🛡️📉

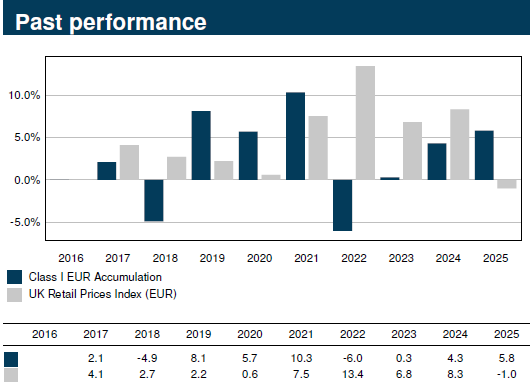

Historical Performance

The long-term track record illustrates the fund’s asymmetric behaviour across cycles.

It participates in up markets but is designed to reduce drawdowns during stress periods, which is central to its compounding logic. 📈🧭

Source: Key Investor Information Document (KID), Trojan Fund (Ireland),

This chart shows annual returns of the Class I EUR Accumulation compared to the UK Retail Prices Index (EUR). The data confirms three key elements:

Strong participation in 2019 and 2021

Controlled downside in 2018 and 2022

Positive real return over the medium term

The negative year in 2022 reflects the broad fixed income shock, yet the recovery in 2023 and 2024 reinforces the portfolio’s structural resilience.

The fund is not built to avoid volatility entirely, but to manage it intelligently.

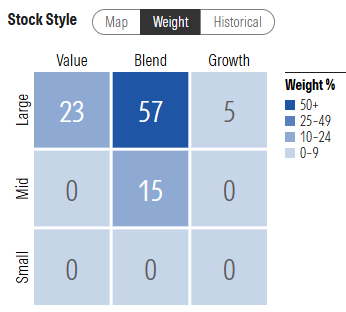

Equity Style and Positioning

The equity allocation is concentrated in high-quality, large-cap businesses. The style box shows a dominant allocation to large blend and large value categories, with limited exposure to growth extremes and virtually no small-cap bias.

Source: Morningstar, Data as of 31 December 2025

The portfolio typically holds between 25 and 30 equity positions, reflecting conviction-driven selection rather than index replication. 🎯📊

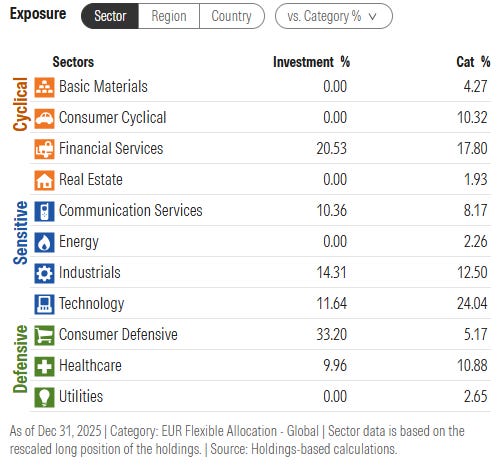

Sector allocation highlights a structurally defensive bias, with a meaningful overweight in Consumer Defensive exceeding 30 percent, complemented by exposure to Financial Services, Industrials and selectively positioned Technology.🧩💻

Source: Morningstar, Data as of 31 December 2025

The combined weighting in Consumer Defensive and Healthcare underscores a preference for businesses with resilient demand, pricing power and durable cash flow generation, characteristics that tend to hold up across economic regimes and inflationary environments.

However, sector positioning only tells part of the story. The broader risk architecture becomes clearer when analysing asset allocation across asset classes.

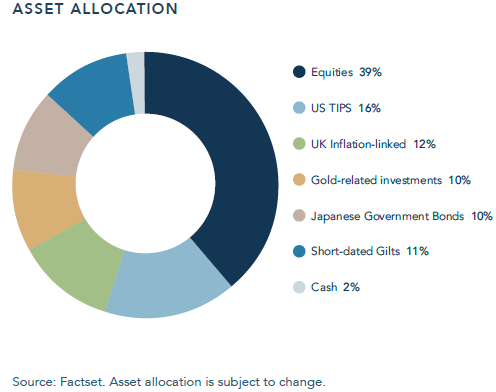

Source: FactSet, Asset Allocation Data.

We can notivce that equities represent 39% of the portfolio, confirming that this is not an equity-heavy strategy disguised as multi-asset. The remaining allocation is diversified across inflation-linked bonds, sovereign debt, short-dated gilts and a strategic 10% allocation to gold-related investments, reinforcing the portfolio’s defensive architecture.

Importantly, the gold exposure is implemented primarily through physically backed instruments rather than mining equities, strengthening its role as a macro hedge against currency debasement, systemic risk and inflation shocks rather than adding equity-like volatility. 🪙🌍

With approximately 60% of the portfolio allocated to defensive and real-asset components, the structure is clearly designed to balance growth participation with capital stability.

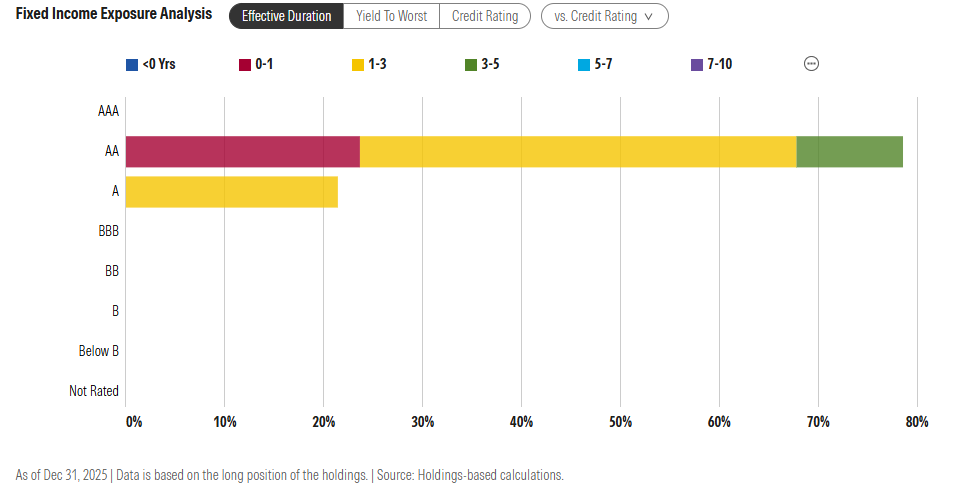

Fixed Income Structure & Defensive Architecture

A core pillar of the strategy is high-quality sovereign exposure.

The duration analysis shows exposure concentrated in higher quality segments, primarily AA and A-rated government debt. The maturity distribution indicates meaningful duration exposure, particularly in the 1–5 year and 5–7 year segments.

Source: Morningstar, Data as of 31 December 2025

This structure historically provides convexity during risk-off environments and economic slowdown. The bond sleeve acts as a shock absorber rather than a yield-maximisation engine. 🏛️📉

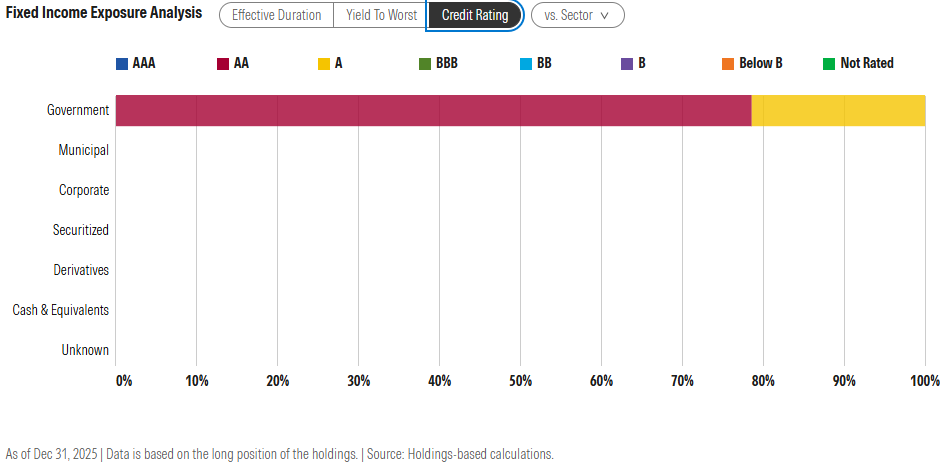

Source: Morningstar, Data as of 31 December 2025

On the toher hand, credit quality breakdown confirms that government bonds dominate the fixed income allocation, with minimal exposure to lower credit tiers. There is no structural reliance on high yield or credit beta. This is deliberate and aligned with the capital preservation mandate. 🛡️📊

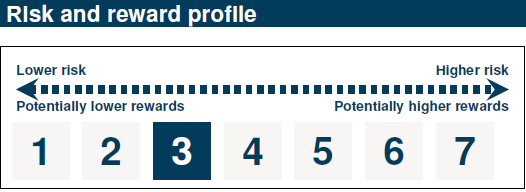

Risk and Reward Profile

The share class is categorised as Risk Level 3, indicating moderate volatility. This positioning reflects the balanced multi-asset nature of the strategy.

Source: Key Information Document (KID), Trojan Fund (Ireland)

The classification underscores that this is not a pure equity vehicle, nor a low-risk fixed income fund. Instead, it sits in the middle of the spectrum, aiming to deliver controlled growth with moderated risk exposure. 🔍📉

Fund Managers

The strategy is led by a highly experienced investment team with deep expertise in multi-asset portfolio construction and long-term asset allocation, bringing together more than 30 years of experience and combining strategic vision with disciplined investment execution.

Sebastian Lyon, Founder & Chief Investment Officer

Charlotte Yonge, Senior Fund Manager

What Makes the Fund Attractive

First of all capital preservation is structural, not tactical. The defensive mix of high-quality equities, sovereign bonds and gold is permanently embedded in the portfolio, not introduced only in downturns.🧠📈

Ultimately, the strategy is genuinely unconstrained. It does not track an equity benchmark or replicate a traditional 60/40 model; allocation decisions are driven by valuation discipline and macro risk assessment.

The strength of Trojan Fund lies not in aggressive upside capture, but in risk-adjusted compounding discipline. 🏅🌍.

Finally, we leave here two recent interviews with Sebastian Lyon, where shares deeper insights into his investment philosophy . These conversations provide valuable context on how the strategy is being navigated in today’s macro environment and offer a clearer understanding of his nvestment approach.

What do you think about this fund? Did you know about it before this lecture?

Please, let us know in the comments.👇

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.