Executive Summary

Storm Bond Fund has attracted the attention from many investors for one reason: Investing in high yield bonds combining high long-term returns (7%+annualised over 10 years) with low reported volatility and moderate recent drawdowns.

The superficial conclusion would be that the fund is “high yield without the pain” however, the correct conclusion is more nuanced.

Name: Storm Fund II – Storm Bond Fund RC

ISIN: LU0840158819

Asset Manager: Storm Capital Management AS

Fund Structure: UCITS SICAV (Luxembourg)

Fund Type: Active Corporate Bond Fund

Asset Class: Nordic Corporate & High Yield Bonds

Share Class Currency: EUR (Hedged)

Launch Date (Fund): September 2008

What the Fund Is (and Is Not)

Storm Bond Fund is a Nordic corporate bond high-yield fund that uses the Oslo market infrastructure🏦. This matters because the investable universe is not limited to “Nordic domiciled” issuers; it can include non-Nordic companies whose bonds are issued/listed in the Oslo market ecosystem, which has historically been the main venue for Nordic HY as well as offshore/energy services financing.⚙️⚓

It is not a Nordic sovereign risk product. It is credit risk, predominantly high yield.

The base currency is NOK, and foreign-currency share classes are currency-hedged 🔒💱 (the EUR retail class being the typical choice for euro-based investors). This hedge has historically caused the EUR-class to lag NOK returns in most years (carry cost), nevertheless it provided protection in stress episodes where NOK depreciates ( e.g. 2020)

How the Strategy Works

The investment process combines top-down relative value screening with bottom-up issuer analysis, focusing on cash-flow generation, debt sustainability, collateral quality and capital structure seniority.

Crucially, the strategy has evolved materially since 2016. Prior to that period, the portfolio followed a more concentrated, commodity-linked, buy-and-hold approach.🔁

SOURCE: Storm Capital Website. Monthly report - Storm Bond Fund-December 2025

Following the 2014–2015 oil collapse, the fund shifted toward a more asset-backed, value-oriented and actively traded credit strategy, with explicit controls on liquidity, duration and downside risk.📉

Today, returns are primarily driven not by passive carry, but by security selection, price dislocations, restructurings and spread compression, with an active portfolio rotation when risk-reward changes.

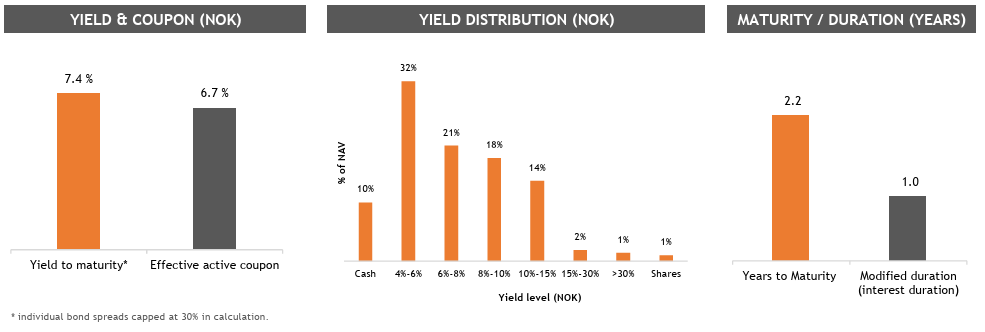

Portfolio Snapshot

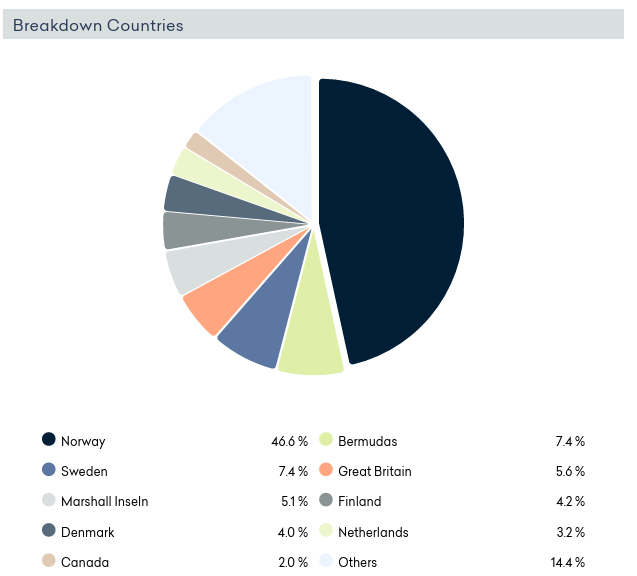

The portfolio is predominantly exposed to Nordic corporate issuers, with Norway as the core geography, complemented as previously commented by selective exposure to international companies issuing through the Nordic market.📊🔍

Source: www.finect.com | Report Date: 1/6/2026

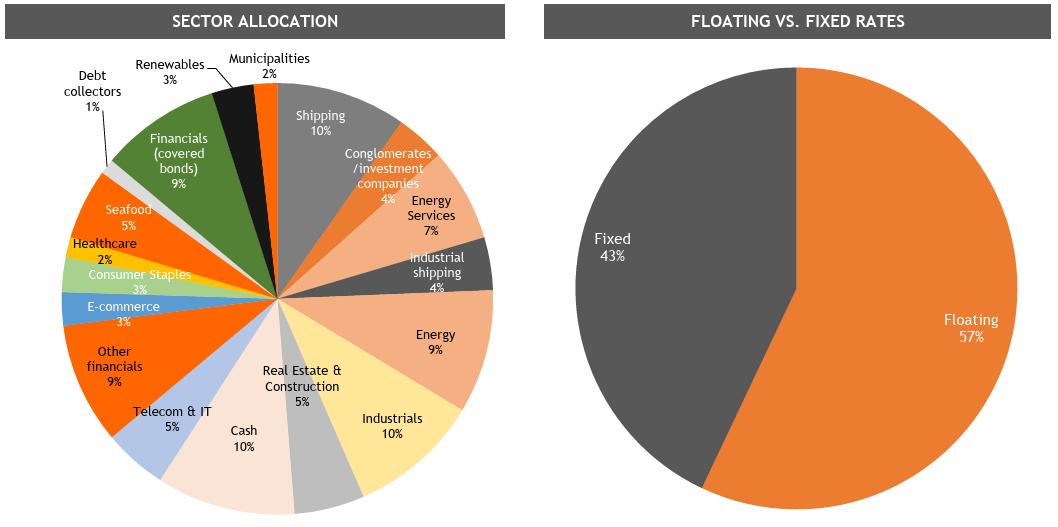

While energy-related services remain an important part of the opportunity set, exposure today is far more diversified across sectors and business models than in the pre-2016 period.

SOURCE: Storm Capital Website. Monthly report - Storm Bond Fund-December 2025

The strategy combines corporate, financial and asset-backed credits within a deliberately short-duration framework, complemented by a meaningful allocation to floating-rate instruments that reduces sensitivity to interest-rate moves.🏰📈

In addition, the fund maintains a recurring liquidity buffer ( close to 10%) which enhances flexibility and allows capital to be deployed opportunistically during periods of market stress.

Altogether, these features reflect a portfolio designed to prioritise resilience and optionality rather than just yield maximisation.

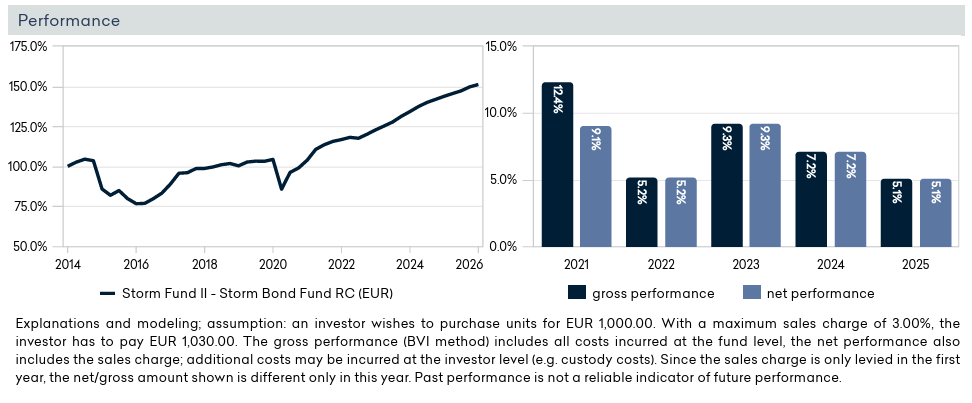

Risk, Performance and Expectations

Source: www.finect.com | Report Date: 1/6/2026

The long-term performance profile highlights the fund’s ability to generate attractive absolute returns across different market cycles. The incentive framework further strengthens this outcome: the fund applies a 10% performance fee above a 3-month Euribor + 3% hurdle, subject to a high-water mark, ensuring that performance fees are earned only through sustained value creation and disciplined risk-taking. 🏦 ⏳

This structure aligns manager incentives with capital preservation rather than short-term return maximisation. For EUR-based investors in hedged share classes, mid-single-digit net annual returns represent a reasonable base-case expectation, with upside primarily emerging during periods of market dislocation.

SOURCE: Storm Capital Website. Monthly report - Storm Bond Fund-December 2025

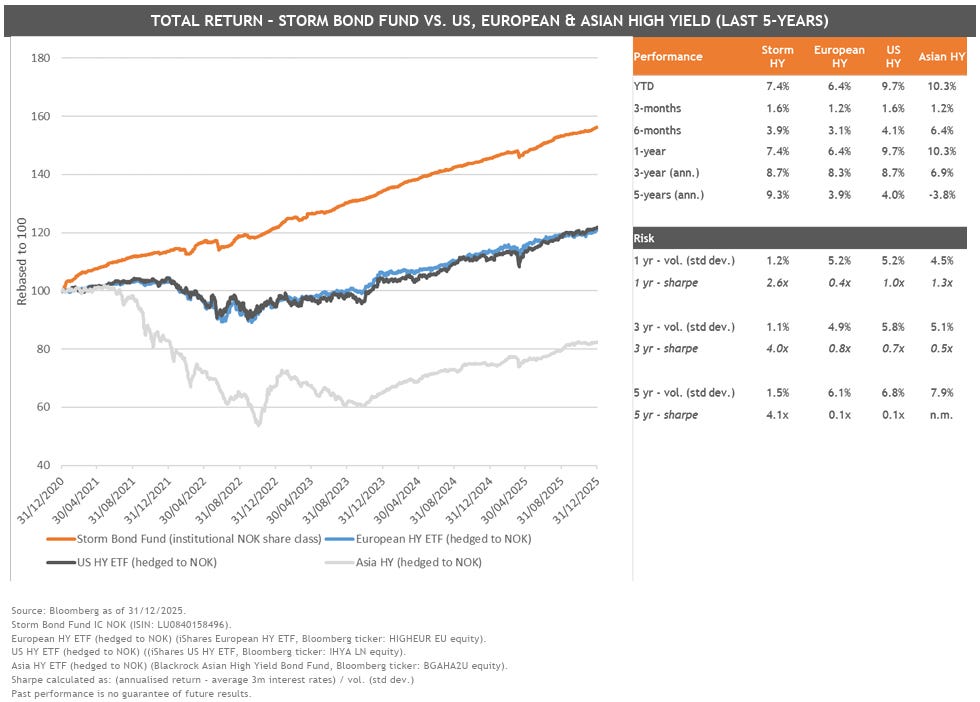

On the other hand, what stands out is not only the level of returns, but how they have been achieved. Compared with US, European and Asian high-yield peers, the fund combines meaningfully lower dispersion of returns with consistently higher risk efficiency, as evidenced by superior Sharpe ratios and materially lower standard deviation. 🛡️📈

This suggests that value creation has come from portfolio construction and credit judgement rather than volatility exposure. In relative terms, the strategy delivers comparable or higher returns while subjecting investors to substantially less variability than traditional high-yield allocations.

The Manager Behind the Fund

The fund is managed by a seasoned Nordic credit team led by Morten E. Astrup, CIO and Founding Partner of Storm Capital Management, with over 25 years of experience in asset management and significant personal investment in the fund.

Morten E. Astrup

CIO | FOUNDING PARTNER

He is supported by Morten Venold, Partner and Portfolio Manager, who joined in 2015 bringing deep Nordic high-yield credit research expertise from Arctic Securities, ABG Sundal Collier and DNB. The team is further strengthened by Gustaf Amlé, Portfolio Manager, with prior experience as a credit research partner at Fearnley Securities.

Morten Venold

PORTFOLIO MANAGER | PARTNER

Gustaf Amlé

Portfolio Manager

Why Look at This Fund?

Storm Bond Fund offers exposure to a differentiated Nordic credit ecosystem where inefficiencies are more frequent than in global HY indices. Its relevance lies in a strategy forged through real stress, demonstrably evolved risk framework and the mentioned alignment that prioritises capital preservation. 💡🧠

This fund would be appropriate for investors seeking defensive income with optionality, rather than pure high-yield beta, the fund represents a credible, experience-driven allocation.

Here are insightful recent videos interviewing Mr Morten.

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.