What the fund is

Most investors have never heard of this fund, and that is precisely where its relevance begins. Frontier markets remain structurally inefficient, not because information is unavailable, but because capital, analyst coverage and investor attention are highly selective.

Name: Magna New Frontiers Fund, R Acc EUR

ISIN: IE00B68FF474

Asset Manager: Fiera Capital (UK) Limited (investment management delegated to the Frontier Markets team within Fiera Capital)

Fund Structure: UCITS, Magna Umbrella Fund plc (Ireland domiciled)

Fund Type: Active equity fund (open ended)

Asset Class: Global frontier markets equities

Share Class Currency: EUR

Launch Date (Fund): 16 March 2011

It is within this context that the fund operates deliberately. Rather than competing in crowded markets where information is rapidly arbitraged, the strategy accepts short-term volatility and noise in exchange for long-term compounding. The investment thesis is not built around timing cycles, but around capturing the gradual convergence between fundamentals and valuations in structurally improving economies. ⏳📊

Source: Fiera Capital, Magna New Frontiers Fund R Acc EUR Factsheet, net performance since launch, data as of 31 December 2025.

The chart above provides a visual representation of this philosophy in action. Since inception, the strategy has delivered a clear divergence versus the benchmark, particularly over full market cycles.

The cumulative performance chart illustrates how patience rather than timing has been the dominant driver of returns. 📈⏳

How the Strategy Works

The Magna New Frontiers Fund is built around a bottom-up, fundamental investment process focused exclusively on frontier markets, where inefficiencies persist for longer due to limited analyst coverage, constrained liquidity and lower institutional participation.

The strategy does not define itself as pure value or growth; instead, it targets mispriced companies with improving fundamentals, where earnings power, balance sheet quality and governance are on a clearly positive trajectory but not yet fully recognised by the market. 🔍🌍

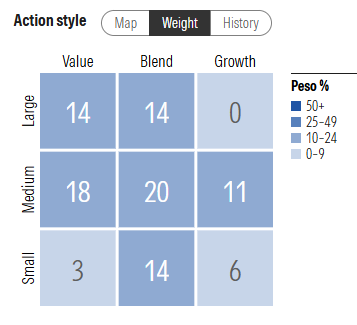

Source: Morningstar, equity style box based on portfolio holdings of the Magna New Frontiers Fund, as reported in the Magna New Frontiers Fund – R Acc EUR Factsheet, data as of 31 December 2025.

Capital is deployed without targeting specific style factors, which explains the presence across different segments of the style box. These exposures simply reflect where the managers find attractive valuations and improving fundamentals at a given point in time, with a consistent focus on financial strength and the ability to fund growth internally. 💼⏳

Portfolio Snapshot

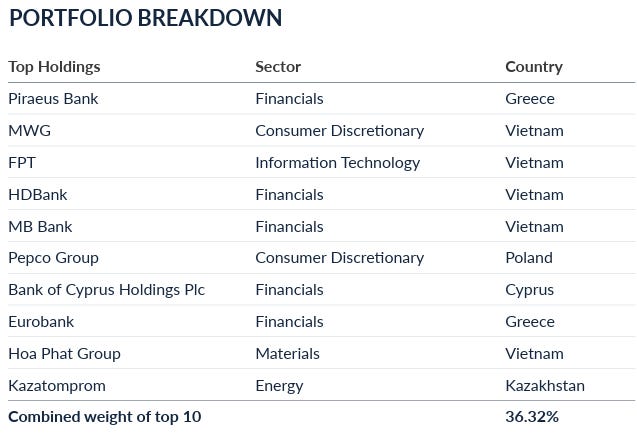

The portfolio is constructed to monetise structural change at the company level, not to express macro views or country narratives. Positioning reflects bottom-up conviction, resulting in a portfolio that is meaningfully decorrelated from mainstream equity markets. Concentration is intentional, with the largest holdings representing businesses where earnings visibility, balance sheet strength and governance improvements are already materialising. 🧠📊

Source: Fiera Capital, Magna New Frontiers Fund – R Acc EUR Factsheet, portfolio holdings data as of 31 December 2025.

At the company level, the managers show particular expertise in identifying banks benefiting from financial deepening, consumer franchises leveraged to rising domestic incomes, and industrial or materials businesses aligned with local investment cycles. 🏦

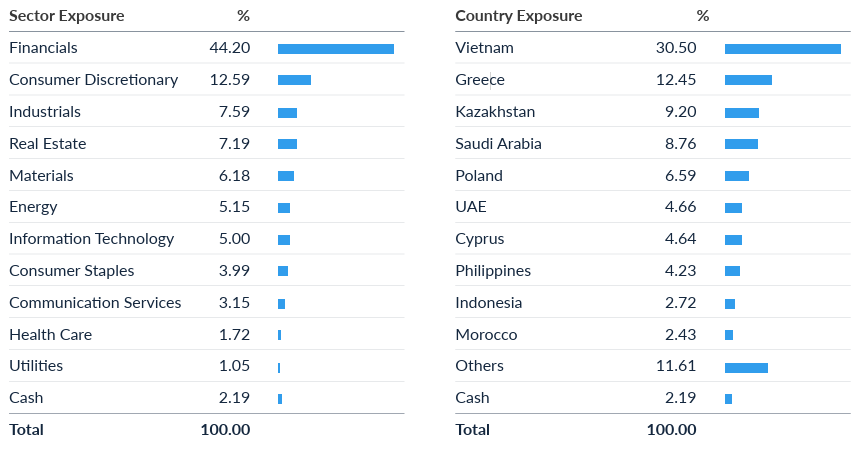

Source: Fiera Capital, Magna New Frontiers Fund – R Acc EUR Factsheet, sector and geographic allocation data as of 31 December 2025.

Geographic exposure follows the same pragmatic logic. Vietnam represents the largest allocation not by design, but because it offers one of the deepest opportunity sets within frontier markets, combining scale, improving governance and earnings visibility. Greece, Kazakhstan and selected Middle Eastern and Eastern European markets complement this exposure, reflecting the managers’ focus on where companies actually generate cash flows and deploy capital, rather than on diversification for its own sake. 🌍💰

Risk, Performance and Expectations

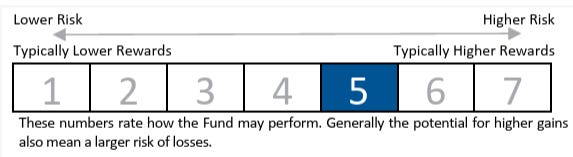

From a risk perspective, the fund sits firmly in the medium-to-high risk category, reflecting the inherent volatility of frontier markets rather than aggressive portfolio construction.

Source: Fiera Capital, Magna New Frontiers Fund – Key Investor Information Document (KIID), risk and reward profile, data as of 11 July 2025.

Drawdowns are an expected feature of the strategy, driven primarily by market liquidity and sentiment rather than deterioration in underlying business quality. The managers accept this volatility as the cost of accessing markets where long-term returns are still driven by fundamentals rather than capital flows. ⚖️📉

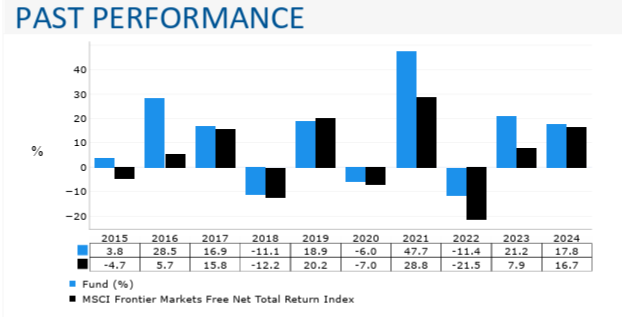

Source: Fiera Capital, Magna New Frontiers Fund – R Acc EUR Factsheet, annual performance versus MSCI Frontier Markets Index, data as of 31 December 2025.

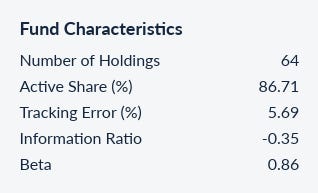

A high active share and meaningful tracking error reflect deliberate positioning away from the benchmark, while a beta below one highlights a focus on company-level fundamentals over market direction. All together, these metrics reinforce the fund’s role as an actively managed, conviction-driven strategy, not an index proxy. 📊🧭

Source: Fiera Capital, Magna New Frontiers Fund – R Acc EUR Factsheet, fund characteristics and risk metrics, data as of 31 December 2025.

The Managers Behind the Fund

The fund is managed by Stefan Böttcher and Dominic Bokor-Ingram, senior portfolio managers and co-heads of the frontier markets team at Fiera Capital.

With decades of combined experience in emerging and frontier markets both bring a deeply fundamental, cycle-aware approach to investing in those markets.

Stefan Böttcher

Senior Portfolio Manager & Co-Head of Frontier Markets

Dominic Bokor-Ingram

Senior Portfolio Manager & Co-Head of Frontier Markets

Why Look at This Fund?

It would be an interesting option for investors already exposed to global and emerging equities. As this strategy provides differentiated return drivers and lower narrative dependency this fund would discorrelate their portfolio by large.

This fund represents a compelling way to access long-term compounding in parts of the world where change is still being priced in gradually rather than instantly. 🌱🚀

What do you think about this fund? Did you know about it before this lecture?

Please, let us know in the comments.👇

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.