INVESTMENT THESIS | VIAFIN SERVICE (VIAFIN)

Built to Last: The Nordic Maintenance Compounder

Hi everyone.

Today I’m bringing you a thesis that genuinely surprised me. It’s not a tech company, it’s not a trend, it’s not a hype play, it’s a small, quiet, ‘boring’ business and honestly that’s exactly why I found it so interesting.

Viafin Service operates at the heart of Finland’s industrial infrastructure, generating recurring revenues, stable margins and a much greater long-term growth potential than meets the eye.

All started with Viafin Oy’s industrial piping operations, which expanded regionally from 2008 and consolidated as Viafin Process Piping Oy in 2011. The company diversified into installation, maintenance, hydraulic, and small-diameter piping, forming Viafin Service Oyj in 2018 and listing on Nasdaq Helsinki First North.

Viafin Service Oyj (VIAFIN)

Through Strategic acquisitions as Gasum Tekniika Oy (Viafin GAS), Astepa Oy, Wind Group, and OT Service Oy, Viafin expanded its services to biogas, industrial maintenance, and wind turbine operations.

Today, Viafin operates across Finland, providing integrated maintenance and installation services for industrial, energy, and mechanical systems.

1. Core business and geographic presence

Viafin is essentially an asset-light industrial maintenance and projects platform operating exclusively in Finland. The business is organized around three main areas:

Process Piping (Viafin Process Piping) – Maintenance, modification and installation of industrial process pipework and related equipment across pulp & paper, chemicals, metals and energy.

Industrial Service (Viafin Industrial Service) – Comprehensive mechanical and multi-disciplinary maintenance services for industrial plants, including workshop services and on-site maintenance units across the country.

Gas & Energy Infrastructure (Viafin GAS & Viafin Wind Service) – Design, installation and maintenance of gas, LNG and biogas infrastructure, and more recently wind turbine maintenance, including responsibility for maintaining Finland’s backbone gas transmission network.

Source: Viafin Website

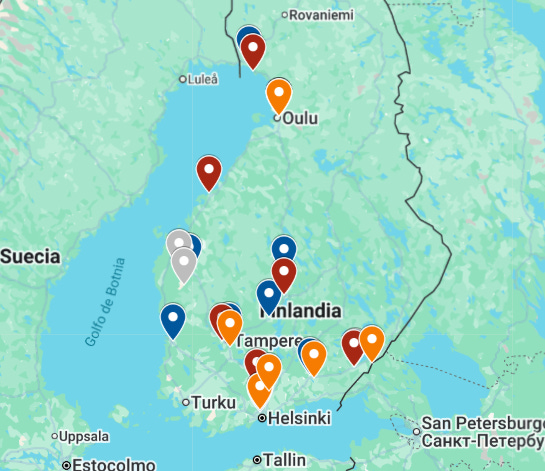

The company operates through a network of its 32 local units spread across 23 locations in all major industrial regions of Finland (e.g. Vantaa, Jyväskylä, Kokkola, Äänekoski, Meri-Lappi and northern Finland), serving blue-chip industrial clients in pulp, board, metals, energy and chemicals.

Source: Viafin Website

From an investment perspective, it is relevant to note that Viafin is a micro-cap company with a market capitalization of roughly EUR 67 million. This makes it a niche, largely undiscovered player within the Nordic market, despite operating a solid, recurring-revenue business with attractive fundamentals. As a result, the company remains under the radar for most analysts and investors, offering potential mispricing and early-stage upside for those willing to look beyond larger, more visible names.

Business Model Structure

Viafin’s operations are built on long-term customer relationships and are organised into two primary segments:

Regional service and maintenance

Project execution.

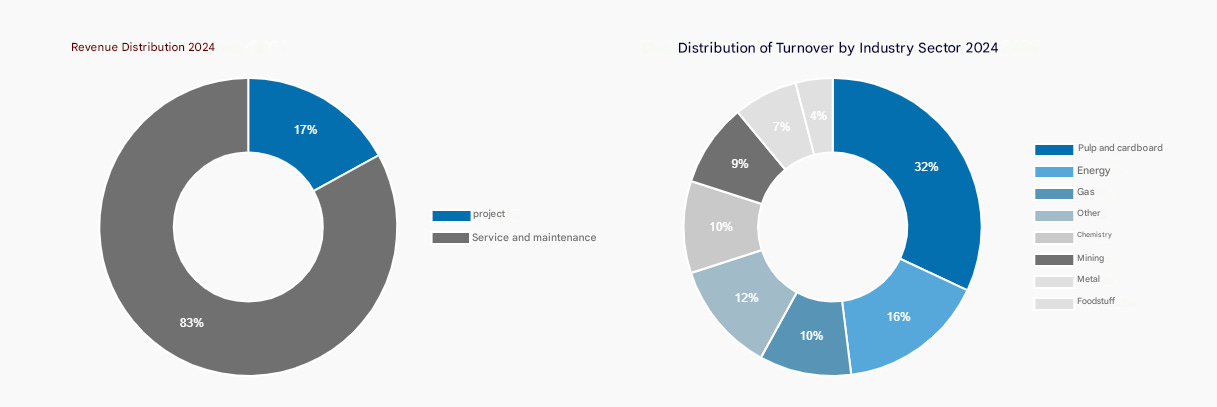

Approximately 75% of revenue is generated from recurring service and maintenance activities, while projects in the EUR 1–5 million range account for the remaining 25%. The company’s strategic focus is on expanding its service and maintenance operations, which provide greater stability and higher visibility. Additionally the fact that they focus on small-mid projects avoid some of the operational risk rather than develop bigger projects which could drive into financial problems.

Source: Viafin Website

Maintenance Demand Is Non-Cyclical

As mentioned, revenues are predominantly recurring maintenance services (roughly three-quarters of sales in recent years) supplemented by higher-volatility project work. This mix underpins relatively stable earnings and cash generation despite the cyclical nature of heavy industry.

For instance, in 2024: 83% of revenue came from maintenance business

(≈ €75.7 million) and 17% from project business (≈ €15.9 million).

Industrial maintenance and repair services are required throughout the economic cycle. During periods of expansion, Viafin supports customers as they increase capacity, modernise equipment or build new facilities. In weaker cycles, maintenance activity often increases as clients extend the useful life of existing assets and optimize production efficiency. As a result, maintenance services constitute a critical and largely non-discretionary component of industrial operations.

“Pipes, Pressure, and Persistent Cashflows”

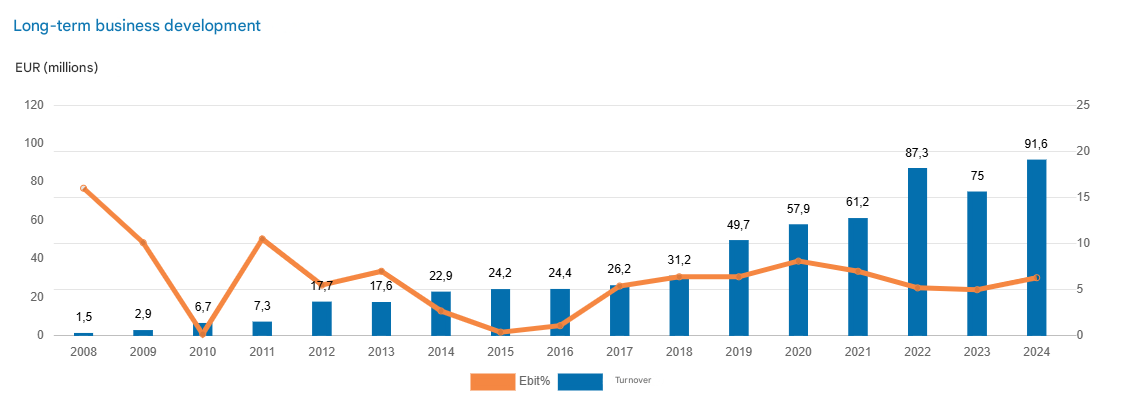

Viafin Service has grown at an average rate of approximately 20% per year (CAGR) between 2018 and 2024. They also have a solid track record of organic growth and successful acquisitions.

Source: Viafin Website

Diversified Exposure Across Industries and Clients

Viafin generates revenue across a broad industrial base, including pulp and paperboard, gas, energy and chemicals. The company continues to diversify its customer portfolio, supported by organic expansion such as growth in the food industry and strategic initiatives like the acquisition of Viafin GAS Oy, which broadened exposure to the gas sector.

Although Viafin works with very large customers (including major industrial groups), orders are not placed centrally at the corporate level. Instead, each factory, plant or operating unit places its own maintenance orders independently.

Source: Viafin Website

Viafin operates with low capital intensity and limited investment requirements. The industry is characterised by strong cash generation and structurally negative working capital, which provides natural financing for operations. Combined with stable cash flows and modest capex needs, this enables a consistent capacity for dividend distribution.

2. Sector Analysis

Estimated Total Addressable Market (TAM)

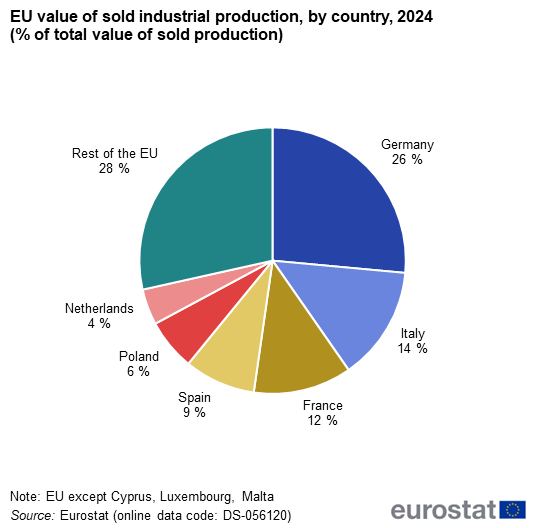

Public data for Finland’s industrial maintenance market is limited, but a rigorous top-down estimation can be built using Europe as the reference point. According to Grand View Research, the European industrial maintenance services market amounted to USD 38.6bn in 2024.

Although Eurostat does not break Finland out individually in this chart, the “Rest of the EU” segment (28%) includes all mid-sized industrial economies such as Finland, Sweden, Austria and others. Within this group, Finland typically accounts for approximately 1.3–1.6% of EU industrial production based on Eurostat production-index data and long-run industrial structure.

Using this proportion and the EUR ~38.6bn European industrial maintenance services market (Grand View Research, 2024), Finland’s implied industrial maintenance market is roughly EUR ~0.5bn. This top-down estimate is fully consistent with industry expectations and broadly aligned with Viafin’s own definition of a ~EUR 2bn total addressable market when including the wider spectrum of mechanical, electrical, automation, piping and project-related industrial services.

Nevertheless, this figure is based on a much broader definition of industrial services, since it encompasses mechanical and electrical installations, automation, piping, project-related work and a wide set of technical services that extend beyond traditional maintenance.

Viafin does not operate across all industrial service categories as its activities are concentrated in piping, mechanical maintenance and gas-related infrastructure, segments that typically represent around 25–30% of the wider industrial maintenance market. Applying this personal adjustment, we can calculate a more immediate TAM for the company, suggesting that the “core segment” TAM is approximately EUR 150–200m for Viafin’s primary service areas.

Source: Viafin Website

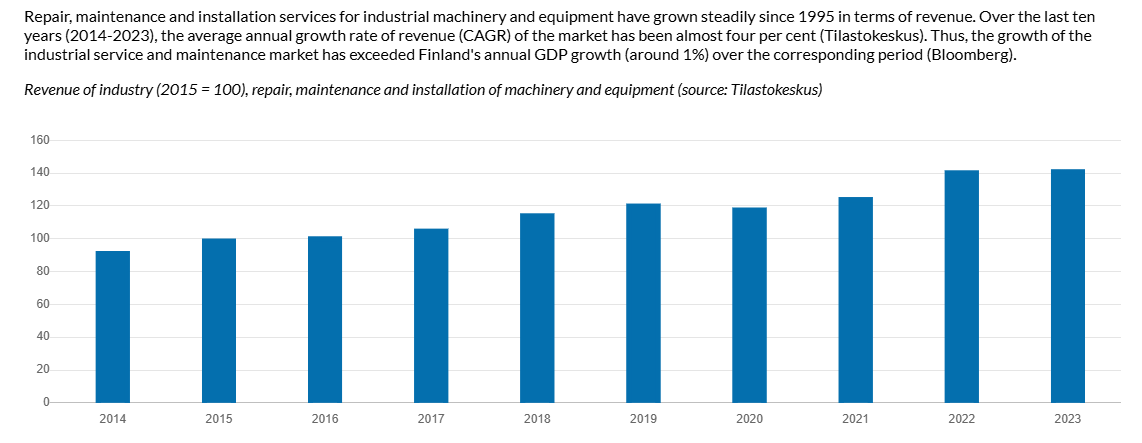

The Finnish maintenance market is local, specialised and capacity-constrained with an estimated annual growth of 4% as shown in the above image.

The opportunity in Viafin is not built around rapid TAM expansion, but around entrenched competitive position, stable cash flows and the defensiveness of maintenance demand.

Relevant Megatrends Impacting the Sector

Beyond the question of market size and valuation multiples, Viafin’s strategic positioning within its sector provides an additional layer of strength.

To complement this defensiveness, the sector is being reshaped by several long-term megatrends that directly support Viafin’s positioning.

Energy transition & decarbonisation.

The shift toward cleaner energy (LNG, biogas, hydrogen, wind) increases the need for sophisticated piping solutions and specialised maintenance. Viafin is already active in LNG and biogas infrastructure and has expanded into wind turbine services, making it well placed to capture maintenance demand across emerging energy assets.Outsourcing of industrial maintenance.

Industrial operators continue to outsource maintenance activities to specialised partners, particularly for high-risk, safety-critical assets such as high-pressure piping, gas networks and large rotating equipment. This structural shift reinforces Viafin’s recurring revenue model and strengthens customer retention.Digitalisation & predictive maintenance.

The adoption of condition monitoring, data-driven maintenance planning and digital productivity tools favours organised, professional service providers. Viafin’s scale, certifications and structured operating model give it an advantage over small independent workshops in meeting these evolving expectations.Safety, regulation and ESG.

Increasing regulatory requirements in process industries and energy infrastructure elevate the importance of compliance, documentation and safety culture. These regulatory requirements create substantial barriers to entry and limit the pool of qualified maintenance providers, Viafin’s strong track record and certified competencies position it as a preferred supplier in environments where regulatory scrutiny continues to rise.

Why the company matters in its sector

We should emphasise that Viafin’s services support critical industrial assets including process pipelines, LNG and biogas facilities, components of the national gas transmission system and wind turbines—where operational failures carry significant economic, environmental and safety consequences for customers. The cost of maintenance in these environments is relatively marginal compared to the potential disruption and damage caused by unplanned downtime, highlighting the indispensable and non-discretionary role that Viafin plays in ensuring operational continuity for its customers.

In summary, Viafin’s relevance stems from its unique positioning: a recurring-revenue platform operating within a specialised, skill-intensive and defensible niche, supported by structural megatrends that reinforce long-term demand for its core capabilities.

Balticconnector – Sector Context

A part of all that we already explained,it is important to highlight that Finland’s energy landscape has changed materially since the interruption of Russian gas flows in 2022. The country now relies almost entirely on its domestic transmission network, LNG imports and the Balticconnector link to the Baltic and Central European system. Pipeline gas remains strategically important, as it provides steady baseload capacity and access to regional underground storage—both essential for security of supply. This diversification increases the strategic weight of Finland’s gas infrastructure and raises the need for intensive preventive maintenance, rigorous inspections and specialised accredited service partners capable of meeting strict regulatory standards.

Source: www.baltic-course.com

Although Viafin does not work on Balticconnector directly, the Balticconnector forms part of the national gas transmission system operated by Gasgrid Finland, a state-owned client for whom Viafin provides accredited maintenance, inspection, calibration and technical services. The existence of cross-border, bi-directional gas infrastructure increases the technical complexity and safety requirements of the entire network, indirectly strengthening long-term demand for Viafin’s high-quality maintenance capabilities.

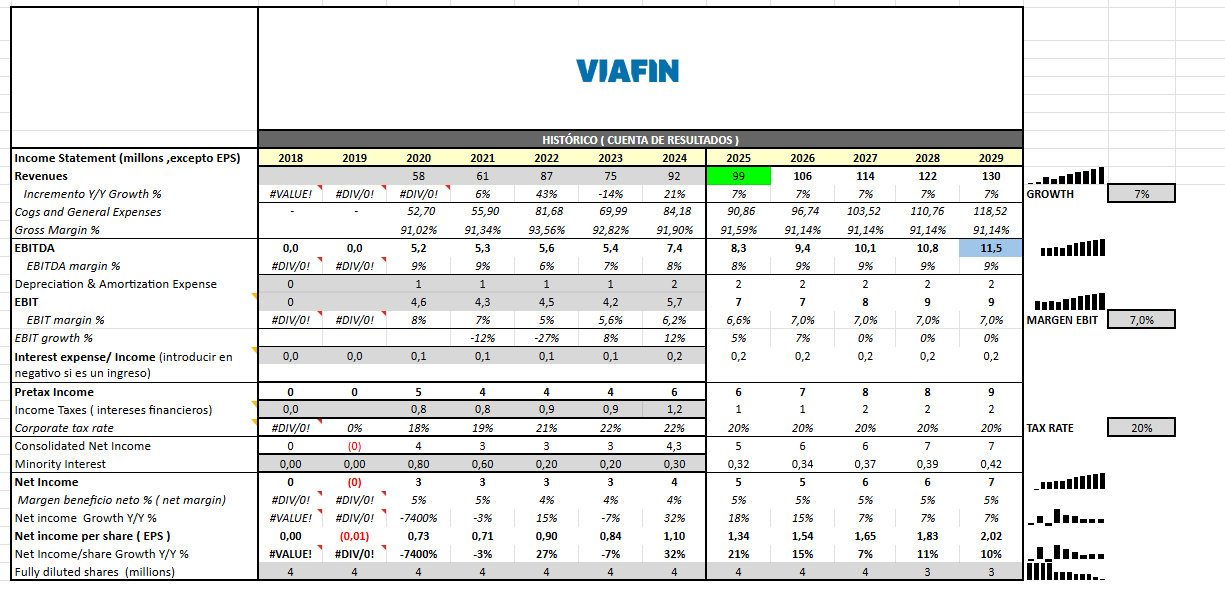

3. Key Financials

The business is structurally asset-light: annual capex on property, plant and equipment has been in the EUR ~0.5–1.4m range in recent years, a small fraction of EBITDA.

Dividend policy is shareholder-friendly: the Board proposed a dividend of EUR 0.65 per share for 2024 (EUR 0.55 for 2023), in line with the objective of paying a growing dividend.

Recent performance trends

Growth: Revenue grew strongly from 2021 to 2022 (+43%), driven by both maintenance and project business. 2023 saw a temporary revenue decline (-14%) due to lower project activity, while maintenance continued to grow. 2024 rebounded sharply (+21%), supported by organic growth, the wind maintenance acquisition and the OT Service acquisition.

Margins: EBIT margins have been consistently in the 5–7% range. 2024 saw margin expansion to 6.3% despite integration activities, moving towards the company’s 8% EBIT target.

Cash generation: Operating cash flow before financial items and taxes was EUR 4.5m in 2024 (EUR 6.6m in 2023), corresponding to a cash conversion of 60.5% vs 122.6% in 2023. The 2024 decline reflects working capital build following growth and acquisitions, rather than structural deterioration.

Balance sheet: The company operates with net cash and high equity ratio, providing ample headroom for further bolt-on acquisitions and dividends. Lease liabilities and performance guarantees are manageable relative to EBITDA.

Overall, Viafin combines steady mid-single-digit normalized growth, solid mid-single-digit EBIT margins and a conservative capital structure.

Main Competitors & Positioning

Viafin operates in mature and relatively stable industrial service markets, serving large blue-chip industrial clients. The Finnish market includes both sizeable international service groups and numerous smaller regional contractors. Within industrial piping and mechanical maintenance, the competitive landscape remains fragmented.

The main competitors include Caverion and Quant,, alongside a wide range of smaller local or regional operators. The market is fragmented, however, few players capture a significant share of demand:

Caverion – Broad multi-technical provider focused on HVAC, electrical systems, building technology and general industrial services. Strong Nordic presence, but limited specialisation in complex process piping.

Bravida – Large Nordic operator with emphasis on electrical and HVAC installations. Industrial process expertise is comparatively shallow.

Enersense International – Active in energy, industrial and infrastructure projects. More exposed to project-driven revenues and cyclical investment activity.

Quant – Global outsourced maintenance provider serving multinational industrial clients; broad competencies but less tied to local plant-level service models.

Competition centres primarily on customer loyalty, service quality, reliability, breadth of offering, technical capability and delivery performance, rather than on pricing alone. Market dynamics are also influenced by resource availability, regional capacity and demand conditions.

These companies offer extensive service portfolios and, in some cases, international scale, nevertheless, their operating models and technical focus areas differ significantly from Viafin’s core operativity. Moreover, Viafin combines national reach with locally embedded service teams across Finland’s key industrial regions. This structure supports fast response times, operational continuity and strong client retention, these are advantages difficult for both large generalist groups and small regional firms to match.

Catalysts & Market Expansion

Viafin has built a clear and consistent track record of acquisitions, strengthening its national coverage and expanding its technical capabilities across mechanical, piping, electrical and wind-related maintenance.

Key transactions include:

Astepa (2021) – now Viafin Industrial Service Kaakkois-Suomi, expanding regional maintenance capacity.

Wind Group business (2023/24) – marking Viafin’s entry into wind turbine O&M and supporting long-term positioning in energy-transition infrastructure.

OT Service Oy (2024) – a mechanical maintenance and workshop provider in northern Finland, adding ~EUR 11.7m of revenue and EUR 1.4m of EBITDA (2023 figures) and strengthening Viafin’s footprint in process industry maintenance.

Bear Group Finland Oy & Karhu Workteam Oy (2025) – the most recent and strategically significant additions. Both focus on industrial electrical maintenance (Bear also includes mechanical services). Following integration, Viafin’s electrical maintenance workforce has doubled from ~50 to over 100 specialised professionals.

Source: Viafin 2025 Presentation Document

According to the new acquisitions and market overview, there are the three relevant catalysts for market expansion in 2025, based on what Viafin now prioritises operationally and where customer demand is structurally increasing:

Industrial Electrical Maintenance — Electrical systems are becoming increasingly central to Finnish industry due to automation, electrification and tighter safety requirements. With industrial sites relying on more complex electrical infrastructure, demand continues shifting toward certified maintenance partners rather than small, local workshops.

Hydrogen & Green-Gas Infrastructure — Finland and the EU are pushing forward with hydrogen, biogas and green-gas projects as part of the decarbonisation agenda. These assets operate under stringent regulatory frameworks—often stricter than natural-gas systems—which limits the number of qualified maintenance providers.

Wind-Turbine Maintenance (O&M) — Wind generation continues expanding rapidly in Finland. Turbine maintenance is non-discretionary, safety-critical and follows predictable service intervals—characteristics that align perfectly with Viafin’s maintenance-centric model.

These are not simply new service lines, but areas where industrial demand, regulation and the energy transition are creating long-term expansion opportunities. Together, they extend Viafin’s addressable market beyond traditional piping and mechanical maintenance and help position the company where Finnish industry is actually moving.

4. Management & Board

Executive team and experience

Heikki Pesu has served as CEO of Viafin Service since 2023, after previously sitting on the Board from 2018 and acting as Chairman between 2019 and 2023. He brings extensive sector experience from senior roles in Finland’s technical-services industry, including two years as CEO of Consti Talotekniikka and a decade as CEO of Are Group, one of the country’s largest building-technology and maintenance companies. His background provides strong operational expertise directly aligned with Viafin’s core activities. Pesu holds 37,540 shares in the company.

Heikki Pesu – CEO

Board composition and governance structure

The roles of Chair and CEO are separated, and the CEO is not a board member, which is positive from a governance standpoint.

The Board of Directors at the end of 2024 comprised four non-executive members:

Marko Sipola – Chairman : Marko Sipola has served as Chairman of Viafin Service since 2022 and has been a Board member since 2017. He previously held several senior roles within the company, including CEO from 2019 to 2023, giving him deep operational and strategic familiarity with Viafin.Sipola holds 2,100 shares in the company.

Tuula Haataja,Ilkka Tykkyläinen , Sakari Toikkanen: Are members of the board.

Viafin’s leadership is clearly aligned with shareholders. Senior executives and board members hold shares in the company, both directly and through management-owned vehicles, and their compensation is complemented by long-term share-based incentive schemes.A four-year share-based plan covered 2020–2023, and a new long-term incentive programme for 2024–2026 has been approved, with treasury shares explicitly reserved for management and board incentive schemes.

“Show me the incentive and I will show you the outcome.” — Warren Buffett

Together, direct ownership and performance-linked equity remuneration create tangible “skin in the game” and reinforce management’s focus on sustainable value creation.

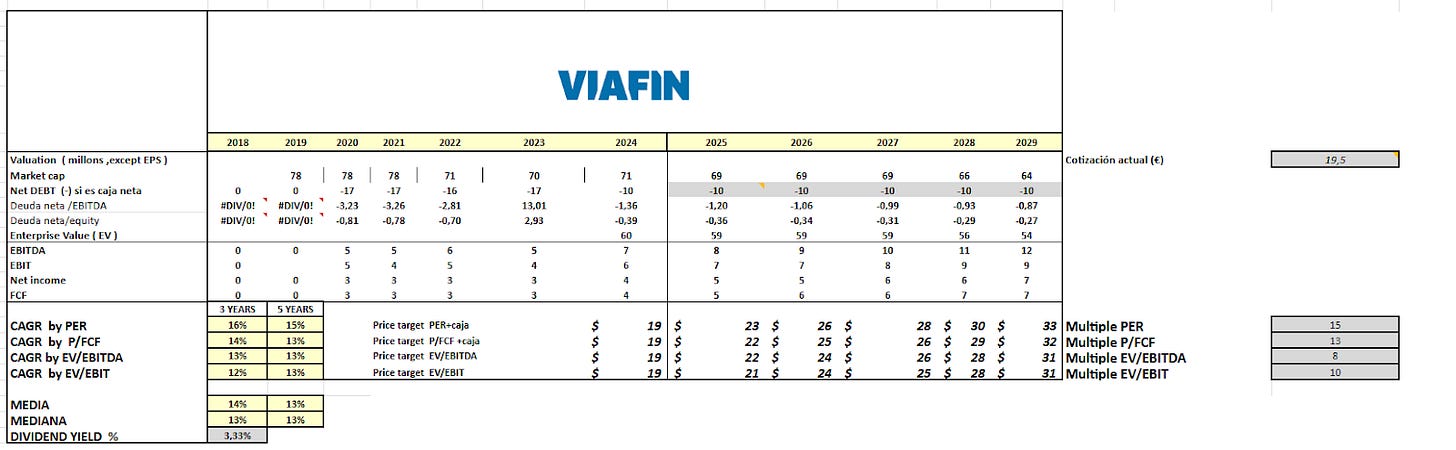

5. Company Valuation

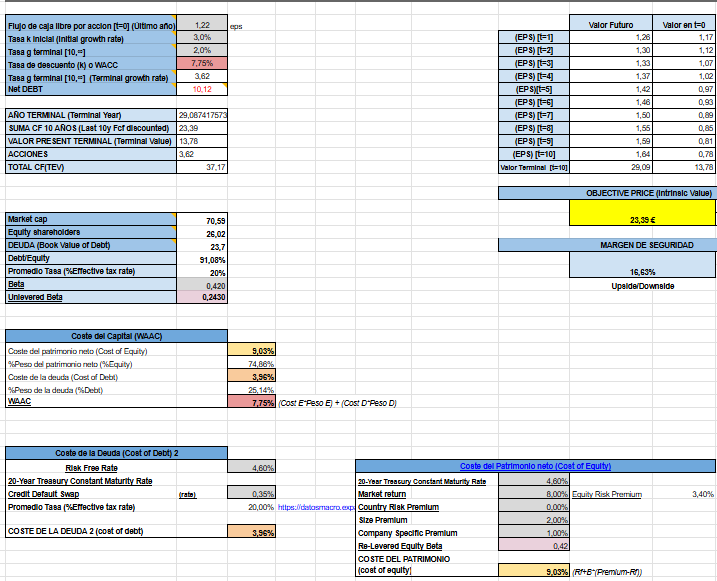

As usual in order to assess the value of the analyzed company I do 3 different approaches: trading multiples, a simplified discounted cash-flow model, and a sensitivity analysis.

Together, these three methods provide a balanced view of the company’s worth.The goal is not to provide a precise target price, but to outline a reasonable valuation range grounded in the company’s fundamentals and reported financial performance.

Note that: (The following is a conceptual valuation framework based on public historical data. It is an illustrative excample and not an investment recommendation.)

Summary of valuation methods

Multiple Valuation Method

At year-end 2024, Viafin’s share price was EUR 19.20, with approximately 3.46 million shares outstanding (excluding treasury shares), implying a market capitalization of around EUR 66.4 million.

The company reported net cash of roughly EUR 10.1 million at the end of 2024 (cash and cash equivalents minus interest-bearing liabilities), resulting in an enterprise value (EV) of about EUR 56.3 million.

On 2024 reported figures:

Net profit attributable to shareholders: ~EUR 4.4m

EPS (2024): ~EUR 1.26

EBIT (2024): ~EUR 5.74m

This translates into the following trading multiples at YE 2024:

P/E (2024): 19.20 / 1.26 ≈ 15.2x

EV/EBIT (2024): 56.3 / 5.74 ≈ 9.8x

Source: Self-made / Own creation

Based on 2024 reported figures (EPS ≈ 1.26, EBIT ≈ EUR 5.74m), Viafin trades at roughly 15x earnings and ~10x EV/EBIT. These levels are broadly in line with typical Finnish and European industrial maintenance peers, which usually trade in the mid-teens P/E and low- to mid-teens EV/EBIT.

Given its net cash position, high share of recurring maintenance revenues and stable margins, the current valuation appears close to fair value, with modest potential upside if the company continues to execute well on growth and margin targets.

DCF Valuation Method

A disciplined, conservative DCF framework for Viafin can reasonably assume:

Revenue CAGR 2025–2029 of ~6–7%, below management’s long-term 10% growth ambition, to reflect cyclicality in project work and a cautious stance on organic growth.

EBIT margin gradually improving from 6.3% in 2024 towards 7.5–8.0% over 5 years, in line with management’s 8% EBIT margin target but allowing for execution risk and competitive pressure.

Sustaining capex at 15–20% of EBITDA, broadly consistent with the low capital intensity seen historically.

WACC in the 7.5–9.0% range, reflecting:

Small-cap status,

Nordic domicile

Low financial leverage (net cash)

Some illiquidity and size premium.

Terminal growth rate around 2.0%, consistent with long-term nominal GDP growth in a mature European industrial context.

Source: Self-made / Own creation

Source: Self-made / Own creation

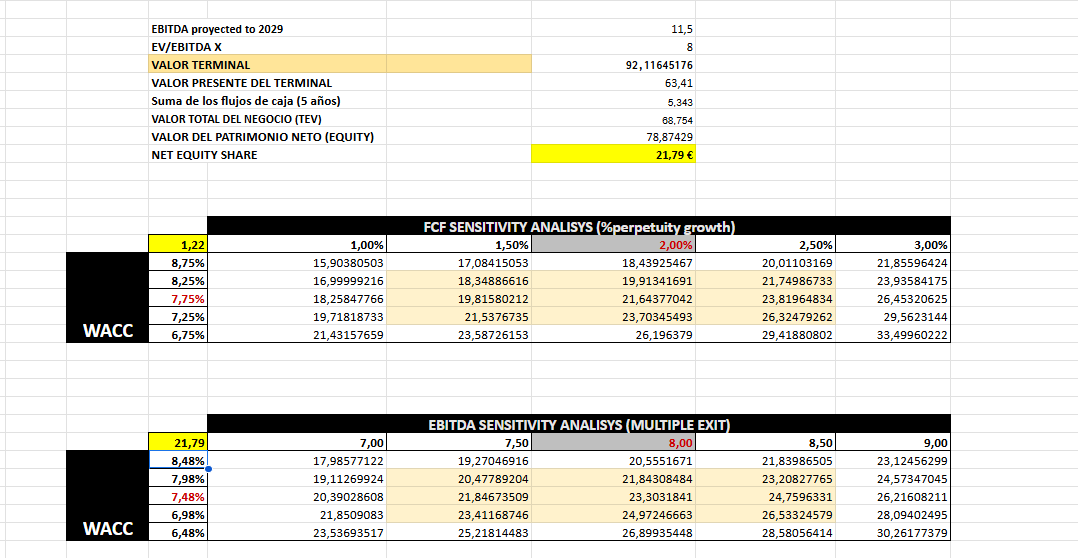

Exit Multiple Valuation Method (EBITDA Sensitivity Analysis)

In this framework, the terminal value is derived by projecting EBITDA to 2029 and applying a range of exit multiples (7.0×–9.0×). The resulting terminal value is discounted back using different WACC assumptions (6.48%–7.98%), and combined with the present value of five years of projected free cash flows.

This approach highlights how the equity value is most sensitive to two variables:

The terminal EBITDA multiple, which captures how the market may value Viafin’s earnings power in 2029

The discount rate (WACC), reflecting shifts in capital costs, macro risk, and equity risk premia

Under a reasonable base case (8× EBITDA, ~7.5–7.9% WACC), the implied value per share clusters around €21–23, broadly consistent with a fair-value range for a stable, net-cash industrial services company. Higher multiples or a lower WACC naturally expand the valuation, while more conservative assumptions compress it toward the high-teens.

Overall, the exit-multiple analysis supports the view that Viafin’s intrinsic value sits moderately above the current market price, with upside contingent on sustained EBIT growth and stable capital costs.

Source: Self-made / Own creation

FCF-Based Valuation (Perpetuity Growth Sensitivity Analysis)

Finally we find again the FCF method in the second table in order to do a final check through a sensitive analysis which evaluates equity value based on discounted free cash flows and a terminal perpetuity model, varying:

WACC (6.48%–7.98%)

perpetual growth rate (1.0%–3.0%)

This approach provides a complementary cross-check to the EBITDA multiple method. The results show:

With a 2.0% long-term growth rate and WACC of ~7.5%, the valuation centers around €21–22 per share.

A more conservative growth assumption (1–1.5%) pulls equity value closer to €16–19,

while stronger perpetual growth (2.5–3.0%) pushes the valuation toward €24–29, assuming unchanged WACC.

Taken together, both sensitivity analyses converge on a coherent valuation range:

Base case fair value: ~€21–23 per share

Upside scenario: €24–29 (lower WACC / higher terminal growth or exit multiple)

Downside scenario: €16–19 (higher WACC / lower terminal growth)

This supports the broader conclusion that Viafin is fairly valued to slightly undervalued.

6. Risks & Threats

Financial risks

Working capital volatility: Growth in projects and acquisitions can temporarily increase working capital, depressing cash conversion (as seen in 2024). If this becomes structural, free cash flow could lag EBITDA.

Dividends and buybacks: A generous dividend policy and share buybacks, if combined with larger acquisitions, could reduce balance sheet headroom over time.

Market and operational risks

Cyclicality of industrial activity: While maintenance is more resilient than new capex, severe downturns in pulp & paper, metals or energy could lead to deferred maintenance and pricing pressure.

Customer concentration: Large industrial clients may represent significant shares of revenue in certain regions or segments, increasing bargaining power and renewal risk.

Project execution risk: Fixed-price projects and complex installations (e.g., LNG terminals, major shutdowns) carry risk of cost overruns and margin erosion if poorly scoped or executed.

Labour availability and wage inflation: Skilled maintenance personnel are scarce; competition for talent and wage inflation could pressure margins if not offset by pricing and productivity gains.

Regulatory and ESG risks

Health, safety & environmental compliance: Working on high-pressure piping, gas infrastructure and wind turbines entails safety and environmental risks. A serious accident or compliance failure could lead to financial liabilities, reputational damage and tighter regulatory scrutiny.

Energy & climate policies: Changes in energy policy (e.g. gas vs electrification balance) could reshape demand in some segments, although Viafin’s diversification into wind and broader industrial maintenance mitigates single-vector risk.

7. Conclusion & Investment Perspective

Bringing everything together, Viafin stands out as a structurally resilient and strategically well-positioned player within the Nordic industrial services landscape. Its combination of recurring maintenance revenues, mission-critical customer relationships and disciplined capital allocation provides a strong foundation for long-term value creation.

Viafin Service represents a high-quality, niche industrial maintenance platform with:

Strong positioning in critical process and gas infrastructure,

Predominantly recurring, non-discretionary maintenance revenues,

Solid mid-single-digit margins with credible upside potential,

Very conservative balance sheet and low capital-intensity profile

Clear strategy rooted in organic growth and targeted bolt-on M&A.

From an institutional investor’s perspective, Viafin fits naturally as:

A defensive Nordic small-cap industrial compounder,

ESG-aligned enabler of energy-transition and infrastructure reliability, and

Potential consolidation platform in a fragmented Finnish/Nordic maintenance market.

If you found this analysis helpful, feel free to share it or leave a comment.

Your feedback genuinely helps us refine and improve future work.😃⬇️

May the investment be with you.👔☕💼

For inquiries or collaboration, you can reach us at

info@magnoinvestments.net

Magno Investments Research

🔔 IMPORTANT REMINDER 🔔

If you can’t find the newsletter, please check your SPAM BOX. And mark this address as ‘not spam’. If it is not in your spam folder either, you should have a look in the PROMOTIONS tab.

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments does not represent a financial advisory service or investment service. All information provided and given by Magno Investments is of an educational and informative nature and in no case implies any kind of recommendation to buy or sell any securities. Carlos Chaume and Magno Investments Research are not responsible for the use made of this information or the veracity of its sources. Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do so.