INVESTMENT THESIS | L.D.C. S.A (LOUP)

The Industrial Core of Europe’s Food System.

1. Introduction

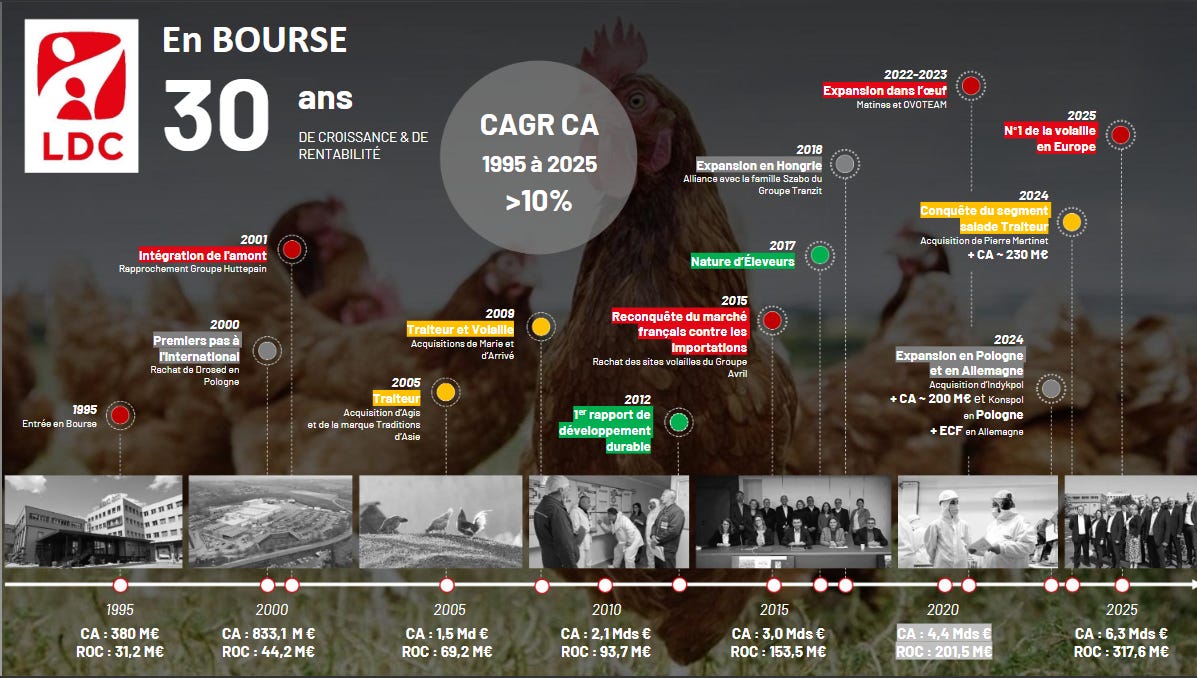

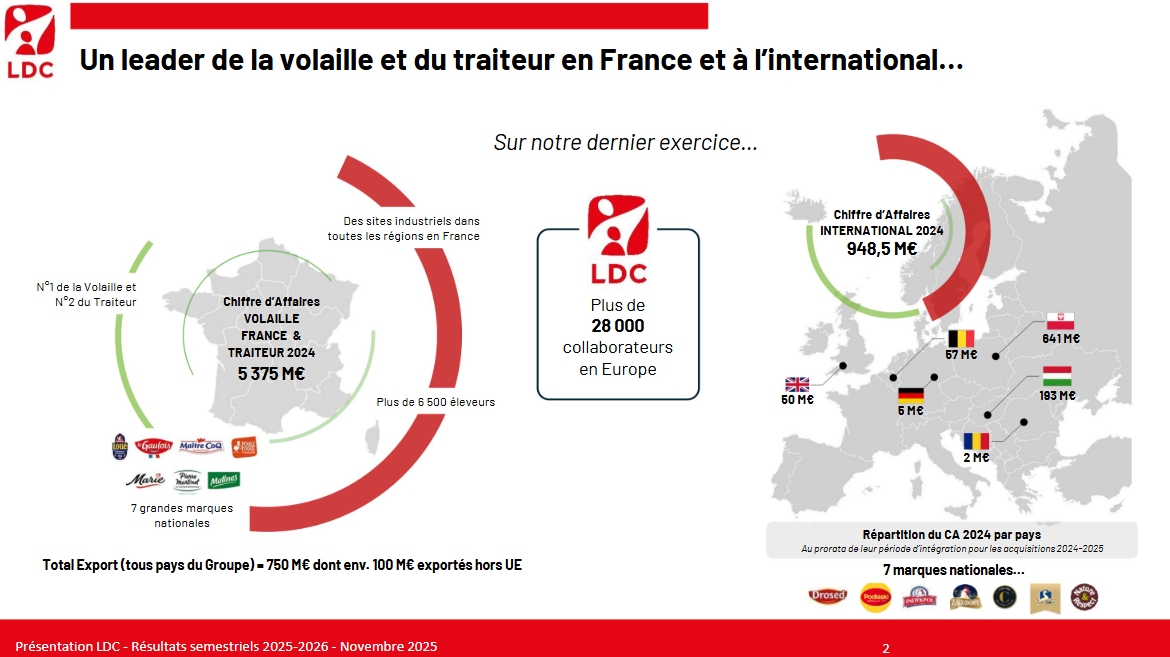

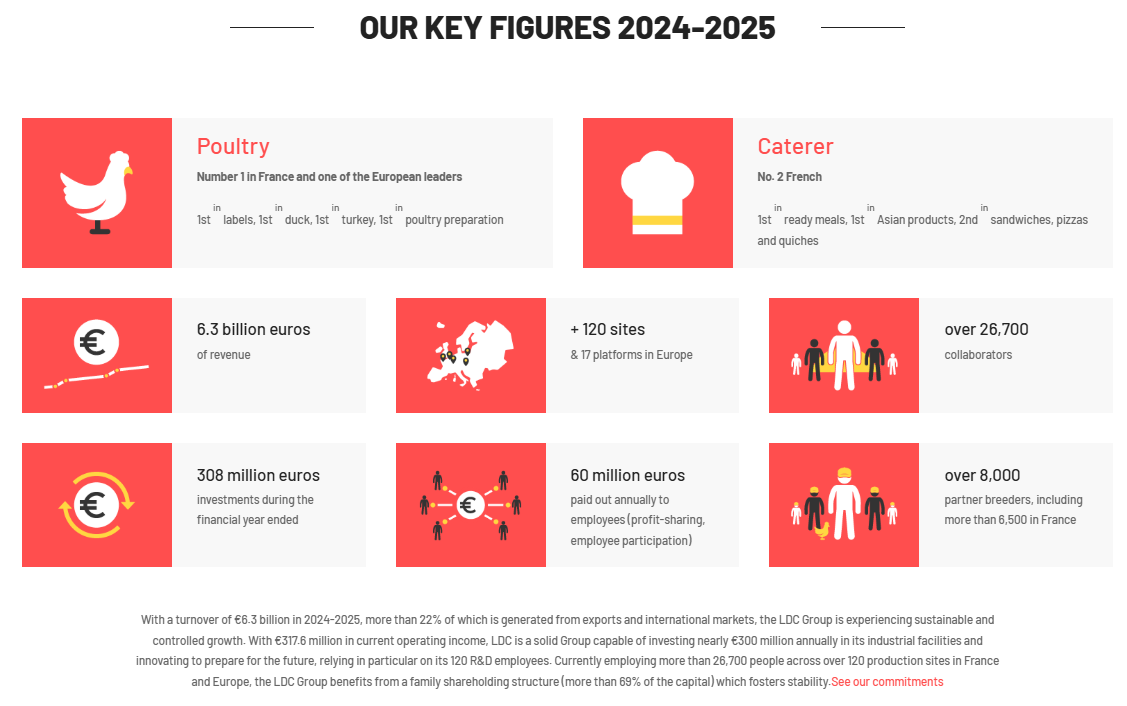

LDC Group is a French, family-controlled food company with more than a century of operating history. Founded in 1909 by the Lambert family, the Group has evolved from a local poultry business into one of Europe’s largest integrated protein and convenience food platforms. Today, LDC operates at industrial scale across more than 100 sites in Europe, employs over 26,000 people and generates over €6 billion in annual revenue.

Source: LDC Group, Half-Year Results FY 2024–2025 – Investor Presentation, November 2025

What makes LDC particularly interesting from an investment perspective is not rapid growth or margin expansion, but the durability of its model. The company operates in essential food categories, holds leading market positions in France, maintains a conservative balance sheet and reinvests heavily to protect long-term competitiveness. LDC is best understood as a defensive industrial compounder rather than a cyclical commodity producer.

2. Sector Analysis

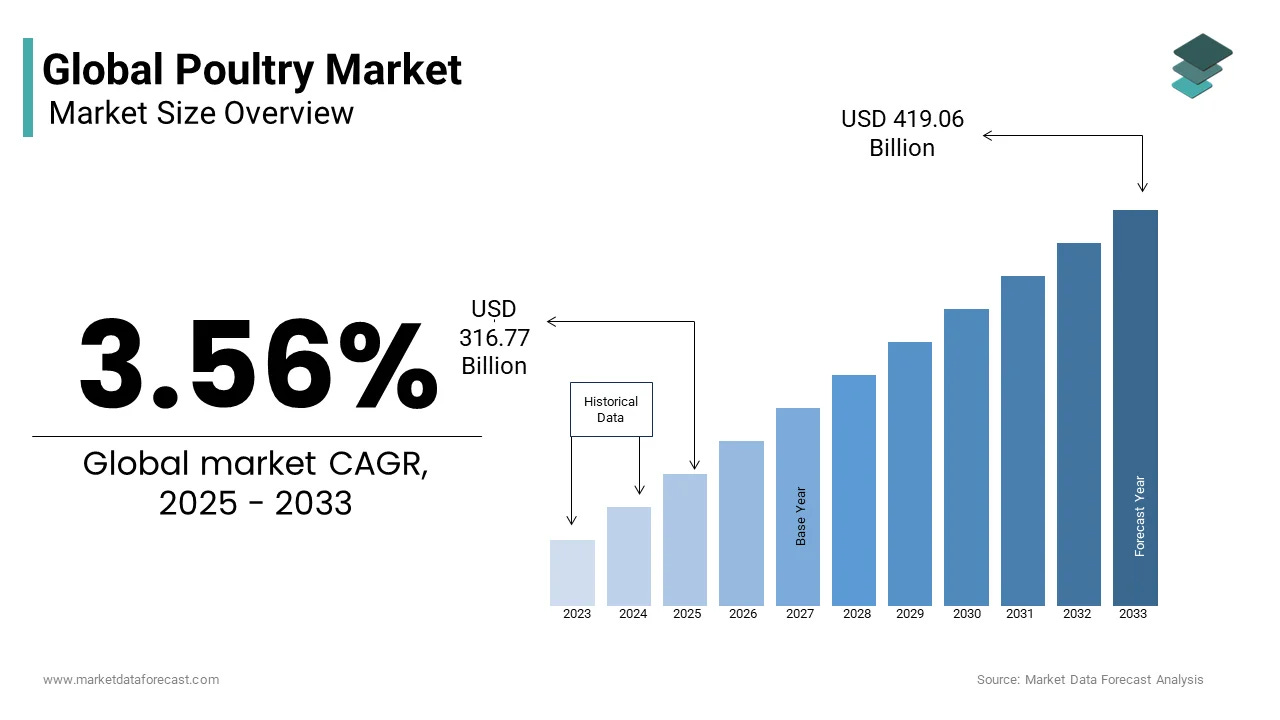

The global poultry market is one of the largest and most structurally resilient segments within the food industry. Poultry has become the most consumed animal protein in many developed markets due to its affordability, efficiency and versatility. If we compare it with beef or pork, poultry offers a lower cost per kilogram of protein, shorter production cycles and better feed conversion ratios, making it structurally advantaged in an environment of cost-conscious consumers and constant rising input prices.

Source: Market Data Forecast – Global Poultry Market Analysis

In Europe, poultry consumption has shown steady long-term growth, supported by population stability, changing dietary habits and as emntioned substitution away from more expensive proteins. In fact, France is one of the largest poultry markets in Europe, with poultry firmly embedded in everyday consumption.

Source: European Commission – EU Agricultural Outlook 2025–2035 (AGLINK-COSIMO simulation)

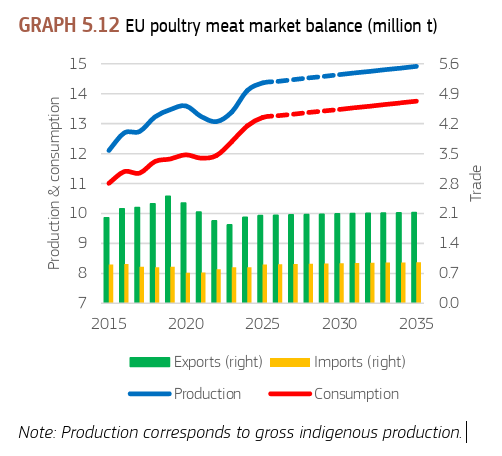

As shown in the above picture, protein is expected to remain dominant in EU diets through 2035. Total protein availability may increase slightly due to an ageing population, with growth mainly coming from dairy, eggs and fish, while poultry stands out as the only meat category not expected to decline.

The total addressable market for LDC therefore combines two attractive characteristics. First, it is large and non-discretionary, anchored in everyday food consumption. Second, it is gradually expanding, both through increased poultry penetration and through the growth of convenience and ready-to-eat formats. This combination provides a solid foundation for long-term revenue visibility.

Source: Mordor Intelligence – Europe Poultry Meat Market Report

According to the European Commission, EU poultry production is expected to grow gradually over the long term, supported by steady consumption and expanding export opportunities. Between 2025 and 2035, total production is projected to increase by around 965,000 tonnes, equivalent to ~0.7% annual growth.

Source: European Commission – EU Agricultural Outlook 2025–2035 (AGLINK-COSIMO simulation)

Crucially, demand dynamics are defensive in nature: volumes tend to remain resilient during economic downturns and often benefit from down-trading effects as consumers shift toward more affordable protein sources.

Finally, within this context, scale and integration matter. Regulatory requirements, biosecurity standards and cost inflation increasingly penalize smaller, fragmented producers. This structural shift favours large, well-capitalised players such as LDC, which are able to invest continuously while maintaining price competitiveness.

3. Core business and geographic presence

LDC’s operations are spread across more than 100 industrial sites in Europe, supported by logistics platforms primarily located in France and Belgium. France remains the operational core of the Group, but international activities have become increasingly relevant, both in terms of growth and diversification.

Source: LDC Group, corporate website

This geographic density is a competitive advantage in fresh protein and prepared foods, where proximity reduces logistics costs, improves freshness and enhances supply chain control. Rather than centralising production, LDC deliberately maintains a regional industrial footprint aligned with local sourcing and consumption.

Source: LDC Group, Half-Year Results FY 2024–2025 – Investor Presentation, November 2025

This dual structure allows LDC to anchor its profitability in a large, mature and defensive domestic market, while gradually expanding its addressable market through international operations.

Importantly, international growth is not pursued at the expense of risk discipline: activities remain largely European, close to core markets, and focused on categories where LDC already has operational expertise.

Operating segments and economic roles

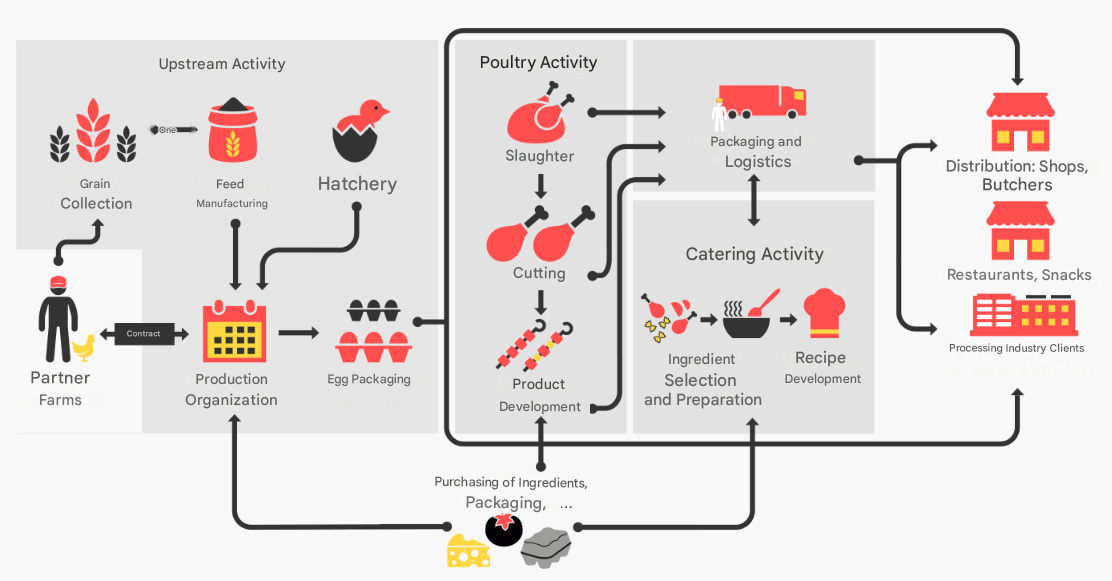

LDC operates a fully integrated supply chain. The Group is involved in every step of the process, from farming and poultry processing to the preparation of finished products. LDC also develops its own recipes in-house, with internal teams in charge of product formulation, quality control and food safety.

Source: LDC Group, corporate website

By controlling production, processing, logistics and distribution, LDC keeps tight control over costs and quality. This structure allows the Group to adjust volumes and product mix as demand changes, while supplying both large retailers and foodservice clients. In a regulated and cost-sensitive industry, this integrated model gives LDC a clear and lasting advantage over smaller competitors.

LDC is organised into four main operating segments, each playing a distinct economic role within the Group.

Poultry France – the core cash-flow engine

Poultry France is the historical and economic backbone of LDC Group, accounting for ~70% of total group revenues. In FY 2024–2025, the division generated €4.4bn of sales, representing 69.6% of consolidated revenues, confirming its role as the dominant cash-flow engine of the group. The division is built around scale, industrial efficiency and recurring demand in a structurally defensive protein category. The division has evolved into a fully integrated industrial platform covering slaughtering, cutting and processed poultry products.

Within this division, LDC operates a portfolio of strong national and regional brands addressing different price points and consumer preferences. Le Gaulois serves as the flagship mainstream brand with nationwide distribution, while Maître Coq and Loué focus on higher-quality, origin-driven and premium segments.

Le Gaulois – Flagship mass-market poultry brand, positioned around “100% born, raised and prepared in France”, anchoring volumes and nationwide distribution within the Poultry France division.

Maître CoQ – Historic poultry brand (founded in 1969) focused on product innovation and value-added formats, reinforcing convenience and service while maintaining close ties with partner farmers.

Loué – Premium free-range and labelled poultry brand (Label Rouge / PDO), representing LDC’s leadership in high-quality, terroir-driven poultry and certified production standards.

Why this division matters:

Its objective is not margin maximisation, but volume stability, asset utilisation and cost leadership This segment anchors the group’s stability and cash generation, allowing LDC to reinvest and absorb volatility elsewhere in the portfolio.

Catering (Traiteur) – value-added and mix improvement

The Catering (Traiteur) division represents LDC’s main source of value-added diversification beyond raw poultry. In FY 2024–2025, the segment generated approximately €1.1bn in revenues, accounting for ~18% of total group sales, making it the second largest division after Poultry France.

While smaller in absolute size, its strategic importance lies in earnings quality and mix improvement rather than volume defensiveness.

Brands such as Marie and other prepared food labels operate within this segment, addressing chilled and ready-meal categories with higher value added. Catering benefits from different demand drivers than raw poultry and provides margin support over the cycle.

Marie – Flagship fresh and frozen prepared-foods brand, forming the backbone of the Catering division since its acquisition in 2009 and anchoring LDC’s leadership in ready meals and convenience foods.

Traditions d’Asie – Specialist brand focused on Asian and exotic ready-to-eat products, addressing structurally growing demand for ethnic convenience food.

Regal’ette – Recognised brand for crêpes and galettes, strengthening the division’s presence in traditional French convenience categories.

Why this division matters:

Catering contributes roughly one-fifth of group revenues and acts as LDC’s main lever for earnings quality, innovation and long-term growth, without compromising the defensive profile of the overall business.

Export International division – controlled growth and diversification

Based on the group’s latest disclosures, Export & International represents around 13–15% of group revenues, making it materially smaller than Poultry France but structurally important as LDC’s main growth and diversification lever.

The division operates across Poland, Hungary, Belgium, the UK, Germany and Romania, with country-specific brands adapted to local consumption habits while following the same industrial logic as in France.

The strategy is deliberately pragmatic: enter fragmented markets with strong consumption fundamentals, acquire local champions, and gradually improve product mix and operational efficiency.

Drosed (Poland) – Leading poultry brand in the Polish market, offering a mix of fresh and value-added products, with a strategic focus on moving up the value chain and expanding into duck and goose specialties.

Goldenfood (Hungary) – Specialist brand in Hungarian poultry, primarily focused on duck and goose products, addressing niche consumption patterns with higher value-added profiles.

Doux – International poultry brand with global reach, marketed in around 100 countries, and strongly positioned in frozen poultry products, including processed items and whole birds.

Why this division matters:

Export & International reduces geographic concentration risk and expands LDC’s total addressable market without altering the group’s conservative risk profile. It provides long-term growth while exposure to structurally growing Central and Eastern European markets.

4. Financial Profile

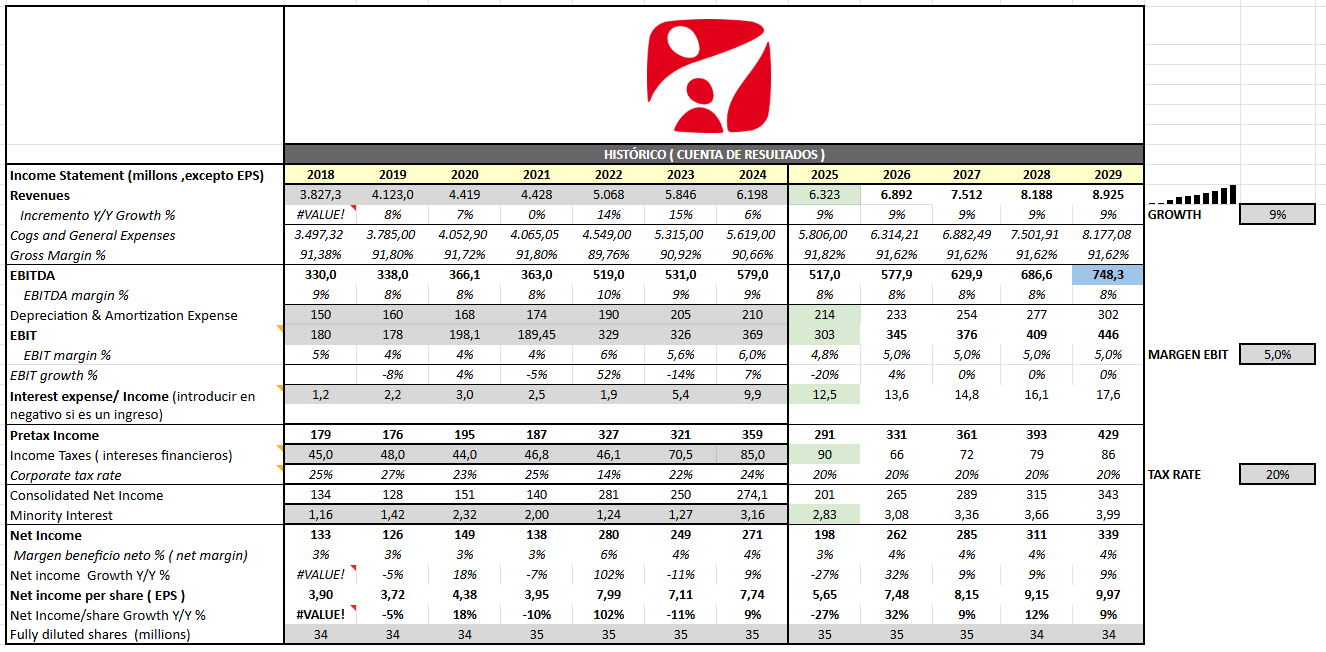

LDC generates over €6.3 billion in annual revenue and operates with structurally moderate but stable margins, as capital intensity is structural to LDC’s model.

The Group consistently reinvests heavily in its industrial base, with annual capital expenditure of around €300 million, primarily dedicated to plant modernisation, capacity upgrades. Despite operating margins typically hover around 5%, reflecting management’s focus on competitiveness

Source: LDC Group, corporate website

LDC’s financial profile is underpinned by a conservative balance sheet. The Group currently operates with net cash of approximately €70–75 million, providing substantial financial flexibility to invest through the cycle. Despite operating with structurally moderate margins, LDC delivers solid returns on invested capital, with ROIC consistently around the 10–11% range, reflecting disciplined capital allocation, high asset utilisation and tight operational control.

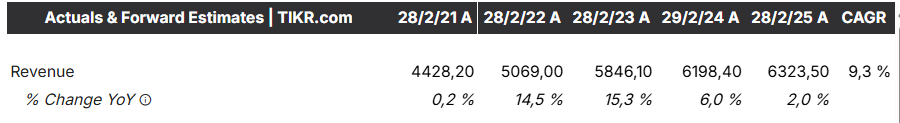

Source: TIKR.com

LDC has delivered consistent top-line growth over the last cycle, with revenues increasing from roughly €4.4bn to over €6.3bn, implying a high-single-digit CAGR (~9%). This growth profile reflects a combination of structurally resilient end markets, incremental volume gains and progressive mix improvement, rather than aggressive price-led expansion.

Source: TIKR.com

Alongside organic growth, acquisitions play a complementary role in LDC’s strategy. Over the last 12 months, the Group has completed several bolt-on acquisitions, adding around €325 million of pro forma annual revenues.

Source: LDC Group, Half-Year Results FY 2024–2025 – Investor Presentation, November 2025

These revenues represent the annualised sales of the acquired businesses. Assuming typical sector margins of 5–7%, this translates into roughly €16–23 million of EBIT, suggesting that acquisitions were completed at around 6–8x EBIT, in line with LDC’s disciplined and conservative capital allocation approach.

LDC is exposed to typical sector risks as input cost volatility and regulatory pressure. However, these risks are structural rather than idiosyncratic;

Execution risks related to the integration of acquired businesses, as well as increased operational complexity from greater scale and geographic diversification, could negatively impact performance over time.

5. Management and ownership – Long-term alignment

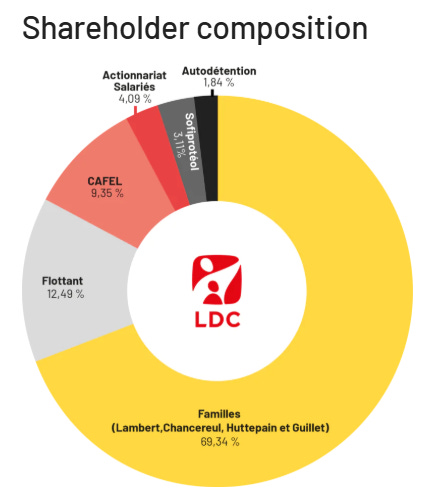

LDC operates under a family-controlled governance structure, with the founding families (Lambert, Chancerel, Huttepain and Guillet) collectively holding close to 70% of the share capital.

Source: LDC Group, corporate website

This ownership structure ensures strategic continuity and a long-term decision-making horizon. While free float is limited, governance is stable and transparent, and capital allocation decisions are conservative by design. The combination of family control, experienced management and operational focus has resulted in a consistent strategic direction over multiple economic cycles.

6. Valuation and investment perspective

As usual in order to assess the value of the analyzed company I do 3 different approaches: trading multiples, a simplified discounted cash-flow model, and a sensitivity analysis. Together, these three methods provide a balanced and ilustrative view of the company’s worth.

The goal is not to provide a precise target price, but to outline a reasonable valuation range grounded in the company’s fundamentals and reported financial performance.

Disclaimer: (The following is a conceptual valuation framework based on public historical data. It is just an illustrative example and not an investment recommendation.)

Here we combine historical reported figures with forward projections based on the company’s own guidance and recent performance trends.

Source: Self-made / Own creation

This valuation approach is based on historical company data combined with forward projections and peer multiples. LDC is compared with listed poultry and food processing peers using P/E, EV/EBITDA and EV/EBIT benchmarks. The model applies sector-average multiples to projected earnings, providing a relative valuation range grounded in comparable market pricing rather than standalone assumptions.

Source: Self-made / Own creation

The DCF valuation is built on historical data and conservative growth assumptions. Applying a 6.41% WACC and modest terminal growth, the model yields an intrinsic value of €107.95 per share.

Source: Self-made / Own creation

Finally, this sensitivity analysis gives additional perspective on how valuation changes depending on key assumptions such as WACC and long-term growth.

Rather than relying on a single output, it provides a valuation range under different possible scenarios. This improves the robustness of the analysis and helps frame the investment case in terms of risk, upside and margin of safety.

Source: Self-made / Own creation

CONCLUSION

LDC is best understood as a stable, family-run food business operating in essential markets with predictable demand.

We should not see LDC as a ¨growth¨ company, but a defensive business with predictable cash generation and long-term compounding potential.

At reasonable valuation multiples, the market effectively prices LDC as a low-growth industrial, however, the market may be underestimating the value of its resilience, scale and optionality in catering and international expansion.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.