What the fund is

INCOMETRIC FUND – EQUAM Global Value is a UCITS equity fund built around a strict, long-term value investing discipline, with a clear bias toward European small and mid-cap companies.

Name: INCOMETRIC FUND – EQUAM Global Value A

ISIN: LU0933684101

Fund Structure: UCITS (Luxembourg-domiciled)

Management Company: ADEPA Asset Management S.A.

Investment Advisor: Equam Capital

Asset Class: Equity (global mandate, European SMID focus in practice)

Share Class Currency: EUR

Launch Date: January 2015

The fund exists to exploit a persistent structural inefficiency: European small and mid-caps are systematically underfollowed by analysts, underweighted by institutional capital and often ignored by index-driven investors.

This structural neglect creates repeated mispricings that are not cyclical but embedded in market structure. 🔍📉

Source: Equam Capital, EQUAM Global Value – Quarterly Report (December 2025).

As a result, frequent and durable valuation gaps emerge between market prices and intrinsic value. These gaps constitute the core opportunity set of the strategy and are the foundation for long-term compounding through disciplined fundamental investing. 💡📈

How the strategy works

The strategy is pure bottom-up and valuation-first. Equam Capital starts with the business, not the macro environment or index composition, analysing companies in depth with a focus on business quality, competitive positioning, balance-sheet strength, cash-flow durability and management alignment. Capital is deployed only when a clear discount to intrinsic value exists and the risk of permanent capital loss is demonstrably limited. 🔍💎

Source: Morningstar (Style Box – EQUAM Global Value Class A).

The portfolio is fully unconstrained: no benchmark tracking, no sector caps and no geographic quotas. This flexibility is reflected in the style box, which shows a clear bias toward small and mid-cap value stocks, where inefficiencies are deepest and active conviction matters most.

Portfolio logic and implementation

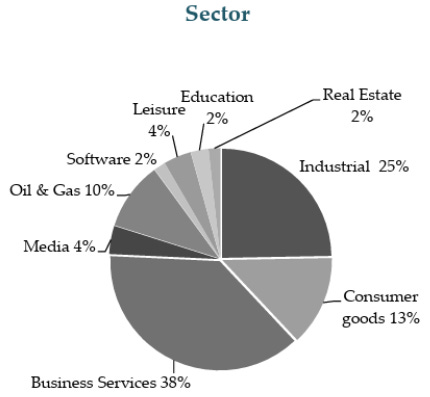

The portfolio is concentrated yet diversified, typically holding around 40–45 companies, with exposure focused toward industrials, business services and selected consumer businesses.

This structure reflects where the team finds the most persistent mispricings and the strongest fundamental asymmetries. 🧩🏭

Source: Equam Capital, EQUAM Global Value – Quarterly Report (December 2025).

On the other hand, illustrated by the country and sector breakdowns, holdings are spread across multiple European markets while remaining focused on sectors with durable cash flows and pricing power. These companies are often niche leaders with aligned ownership structures and the ability to compound value over time. 🌍📊

Source: Equam Capital, EQUAM Global Value – Quarterly Report (December 2025).

Importantly, the portfolio is not built top-down or thematically. Its composition is the natural outcome of searching where inefficiencies are deepest and competition for capital is lowest, ensuring consistency between philosophy, implementation and long-term return potential.

Risk, performance and expectations

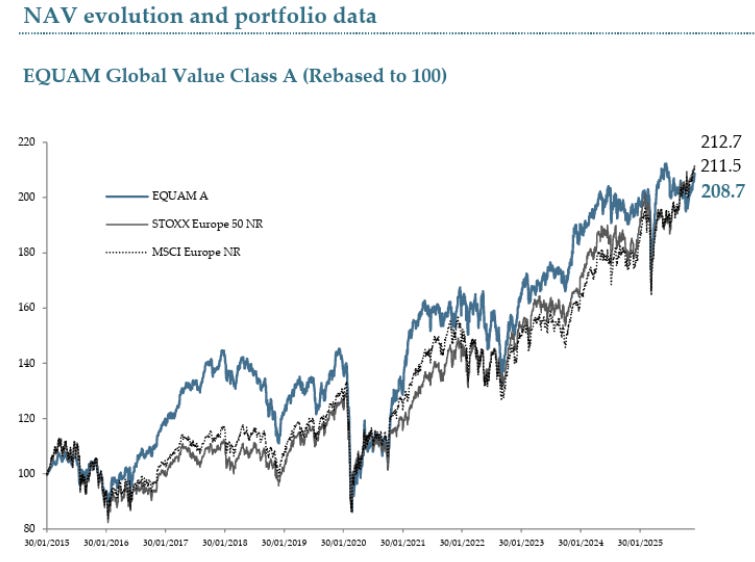

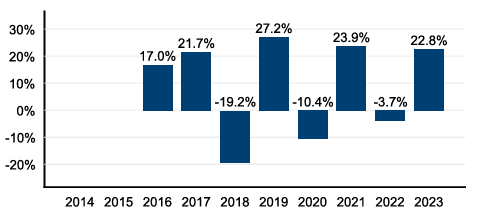

The fund carries a high equity risk profile, reinforced by its exposure to small and mid-cap companies. As shown in the annual return distribution, phases of relative underperformance versus large-cap or momentum-driven indices are an intrinsic feature of the strategy, especially when markets reward liquidity and scale over fundamentals. ⚖️📉

Source: Equam Capital, EQUAM Global Value – Annual & Quarterly Reports and ADEPA Asset Management, Key Information Document (KID) for EQUAM Global Value Class A.

Regarding the returns, they are generated primarily through earnings growth and valuation normalisation, not short-term sentiment or tactical positioning. Over full market cycles, this process allows intrinsic value to be progressively reflected in prices, despite inevitable periods of volatility. 📈🔄

Source: Equam Capital, EQUAM Global Value – Annual & Quarterly Reports and ADEPA Asset Management, Key Information Document (KID) for EQUAM Global Value Class A.

Finally, the risk indicator underlines that this strategy is designed for investors with a long-term horizon, who consciously accept volatility as the cost of accessing structural inefficiencies and sustained compounding.

The managers behind the fund

The fund is managed by the founding partners of Equam Capital, whose personal capital is meaningfully invested alongside their clients’, ensuring strong alignment of interests and a long-term mindset.🧠📈

Source: Equam Capital, official website.

Alejandro Muñoz and José Antonio Larraz are Co-Founders and Portfolio Managers at Equam Capital.

Both have applied the same investment process since inception, deliberately avoiding style drift or tactical rotation and remaining focused on long-term value creation through disciplined fundamental investing.

Why this fund is different

EQUAM Global Value stands apart from its peers in several key ways:

First, it targets a neglected segment of the market where inefficiencies are structural, not cyclical.⏱️🛡️

Second, it operates without benchmark constraints, allowing genuine active management rather than disguised index exposure.

Third, risk is managed at the stock level through valuation discipline and downside analysis, not through diversification for its own sake.

Generally speaking, for a retail investor, this fund offers true differentiation: access to under-researched European businesses, low overlap with mainstream equity strategies, and a coherent value philosophy executed consistently over time.

I leave here an interesant and recent video from Paco Lodeiro - Academia de Inversion, enterviewing them and updating the positions of the portfolio.

What do you think about this fund? Did you know about it before this lecture?

Please, let us know in the comments.👇

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.