Name: Fidelity Funds – Asian Smaller Companies Fund A-Acc-EUR

ISIN: LU0702159772

Asset Manager: FIL Investments International (Fidelity International)

Fund Type: UCITS – Active Equity Fund

Asset Class: Asia ex-Japan Small & Mid-Cap Equities

Share Class Currency: EUR (Unhedged)

Launch Date (Share Class): December 2011

I came across this equity fund while I was looking for strategies that approach Asian markets with a bit more discipline than usual. What stood out wasn’t just the region it invests in, but how it does it: quietly, conservatively, and with a clear focus on business quality and valuation.

The fund invests across Asia-Pacific (excluding Japan), including emerging markets, with a strong bias toward companies benefiting from domestic growth rather than global trade cycles. This part of the market tends to be under-researched and inefficient, which makes it a good hunting ground for active, fundamentals-based investing.

How the strategy works

Stock selection starts with the company, not with macro views or short-term market narratives. The focus is on identifying under-followed businesses that can compound earnings over time.

There’s a clear quality filter in place. The portfolio favours companies with solid cash flows, conservative balance sheets and durable business models. Highly leveraged firms, speculative growth stories and other momentum-driven trades are generally avoided.

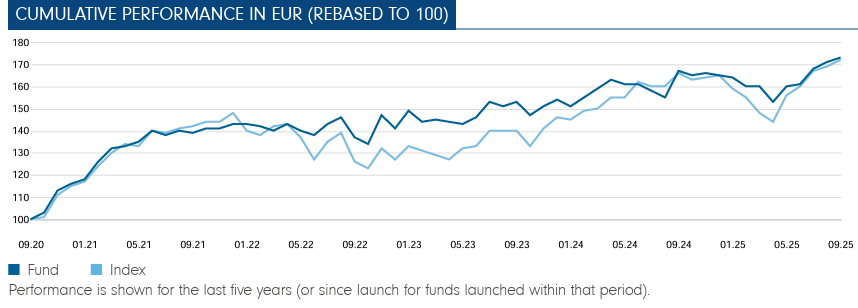

Source: Fidelity International, Asian Smaller Companies Fund

Even though the fund is growth-oriented, it avoids paying excessive multiples and looks for sensible entry points with a margin of safety. Holdings are typically kept for several years, allowing fundamentals to do the heavy lifting.

Source: Morningstar, Asian Smaller Companies Fund

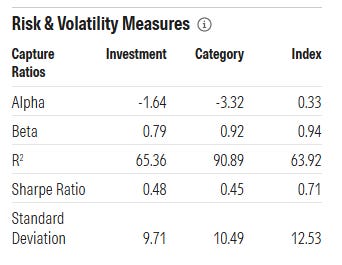

On the risk side, the fund stands out for its strong emphasis on control in a segment typically characterised by high volatility. While as you probably know Asian small caps can be inherently noisy, the strategy consistently prioritises balance sheet strength, earnings visibility and governance quality.

For instance, the fund’s beta of 0.79 indicates lower sensitivity to market movements, reflecting a deliberate focus on downside protection. Overall volatility is also lower than that of most peers.

Generally speaking, the fund displays a more defensive, quality-oriented profile, with returns driven primarily by active stock selection rather than benchmark exposure consistent with a disciplined, bottom-up value approach.

Portfolio snapshot

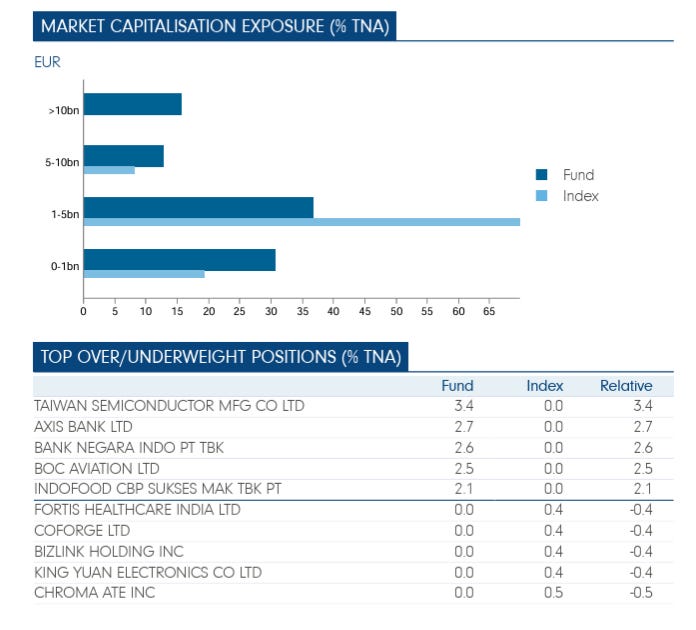

The portfolio is broadly diversified, with around 140 holdings and modest position sizes to control liquidity and downside risk. While the focus remains on small and mid-cap equities, the strategy allows selective exposure to larger companies when quality and valuation are compelling so they can move the liquidity between companies when needed.

Source: Fidelity International, Asian Smaller Companies Fund

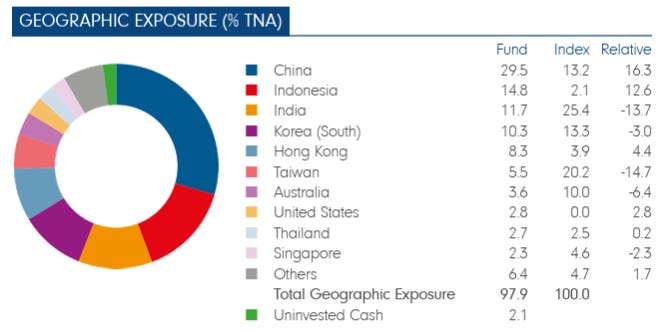

Geographically, the fund is diversified across Asia, with core exposure to India, Taiwan and South Korea, alongside selective positions in China and Southeast Asia whose exposure is intentionally cautious.

On the other hand, the sector allocation is tilted toward consumer-related businesses, non-bank financials, industrials and technology, while structurally avoiding highly cyclical or capital-intensive sectors.

Source: Fidelity International, Asian Smaller Companies Fund

Risk, performance and expectations

This isn’t a low-risk fund. Volatility is in the low double digits, and investors are exposed to emerging market risks, currency movements and the liquidity constraints of small-cap equities.

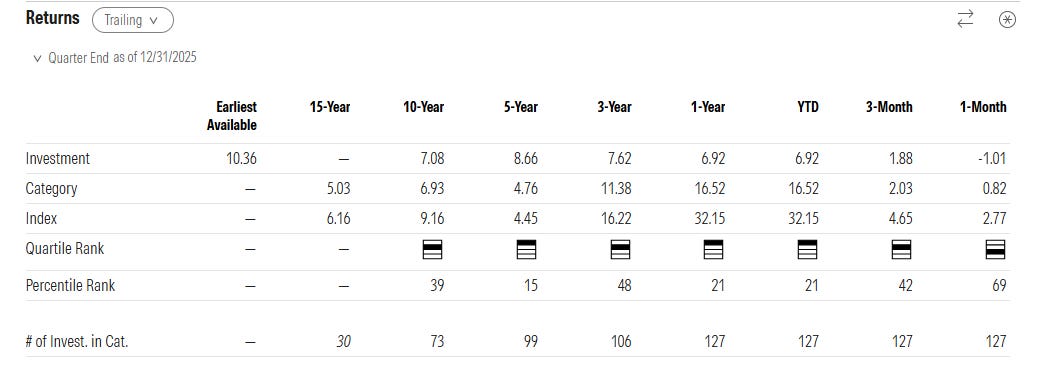

That said, the fund’s quality bias and conservative balance sheet focus have historically helped reduce downside during market stress. Performance over the long term has been competitive, led more by earnings growth than by valuation expansion giving an 7.08 % annualized return in a 10-year period & 8.66 % if we see the last five years.

Source: Morningstar, Asian Smaller Companies Fund

The manager behind the fund

With more than 20 years in Asian equities, Nitin Bajaj’s style reflects a clear value mindset focused less on stories and momentum, and more on business quality and long-term fundamentals.

Rather than chasing what’s working in the market at any given moment, the focus is on businesses that can survive difficult periods and still compound value over time. I personally like his approach which has historically helped the fund hold up better during drawdowns, even if it sometimes lags during speculative rallies.

¨Value outperforms growth because capitalisim works¨

In 2024, Ajinkya Dhavale joined the team, adding further depth to regional research and portfolio construction.

Why look at this fund?

This is not a flashy fund, but it is a disciplined one. The combination of a value and quality-oriented philosophy, an experienced manager as well as a strong research platform makes it an interesting option within the Asia small-cap space.

This fund makes sense for investors with a long-term horizon who are comfortable with volatility and want differentiated exposure to Asian domestic growth as part of a broader global equity portfolio.

As a conclusion we can say that it offers a thoughtful way to gain exposure to a part of the market where patience and fundamentals still matter.

Here you will find an interesting interview which reflects his investment philosophy:

I hope you find the content useful.😀

May the investment be with you.

Magno Investments Research

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments does not represent a financial advisory service or investment service. All information provided and given by Magno Investments is of an educational and informative nature and in no case implies any kind of recommendation to buy or sell any securities. Carlos Chaume and Magno Investments Research are not responsible for the use made of this information or the veracity of its sources. Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it.