Executive Summary

Have you ever heard about this fund?

Most investors haven’t, and that is precisely the opportunity. Eurozone small caps remain structurally inefficiently priced, not due to missing information, but because attention and capital are consistently misallocated. This fund operates in that blind spot, where mispricings persist and fundamentals take longer to be recognised. 🔍📉

Name: BNY Mellon Small Cap Euroland Fund, Euro A (Acc)

ISIN: IE0003867441

Asset Manager: BNY Mellon Investment Management (Newton Investment Management is the investment manager platform commonly referenced for this strategy)

Fund Structure: UCITS, BNY Mellon Global Funds, plc (Ireland domiciled)

Fund Type: Active equity fund (open ended)

Asset Class: Eurozone small cap equities

Share Class Currency: EUR

Launch Date (Fund): 09 May 2003

The edge lies in the gap between macro narratives and company-level reality. Small-cap returns are driven by local demand, niche positioning and capital allocation, resulting in a return profile less correlated to headline macro trends than commonly assumed. 🧩📊

How the Strategy Works

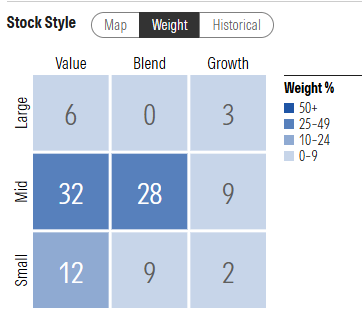

The style profile highlights the fund’s focus on the core of the eurozone small-cap universe, with a clear bias toward mid-sized companies and a balanced blend orientation. This reflects a deliberate investment philosophy: prioritising businesses with proven operating models, visible cash flows and balance sheet control, while avoiding both speculative growth and deep-value situations driven purely by cyclical compression.

Source: Morningstar. Equity Style Box based on portfolio holdings.

The philosophy behind this fund could be described as quality-biased, valuation-aware stock picking. The fund is not trying to win by factor timing; it is trying to win by holding companies that can sustain cash generation and compound through cycles , primarily avoiding the two classic small-cap traps: “story growth” priced for perfection and “cheap” balance sheets that break under stress.⚖️📈

Portfolio Snapshot

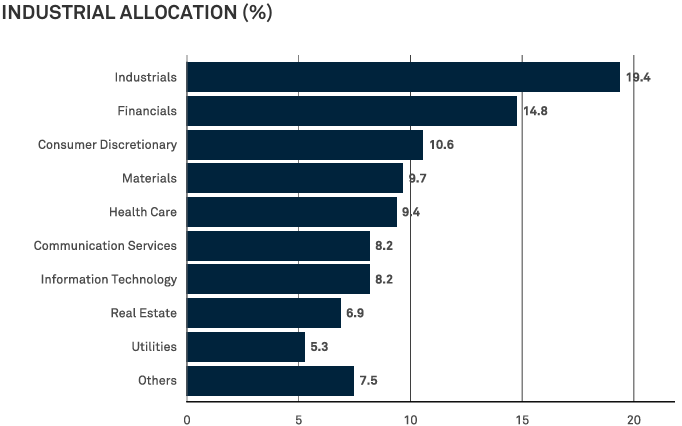

At portfolio level, positioning is driven by economic substance rather than thematic exposure. The sector allocation shows a clear emphasis on industrials and financials, reflecting the managers’ preference for businesses with tangible assets, operating leverage and capital discipline.

These sectors concentrate a large share of eurozone small-cap companies where competitive positioning is local, pricing power is structural rather than cyclical, and value creation depends on execution rather than the narrative and momentum.🏭💶

Source: BNY Mellon Investment Management EMEA Limited. Portfolio data as at 31 December 2025.

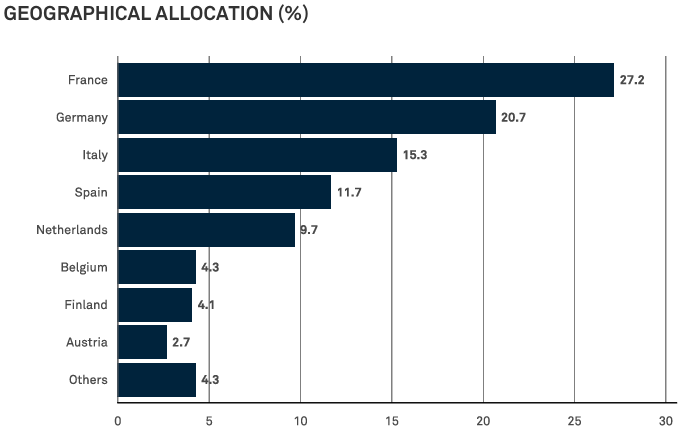

Geographically, the portfolio is concentrated in the largest eurozone small-cap markets, with France and Germany as the core exposures, followed by Italy and Spain.

Source: BNY Mellon Investment Management EMEA Limited. Portfolio data as at 31 December 2025.

This reflects where the opportunity set is deepest and most liquid, allowing the managers to focus on stock selection rather than managing country risk. The emphasis is on where small caps actually trade and operate, not on spreading exposure for diversification’s sake. 🌍📊

Risk, Performance and Expectations

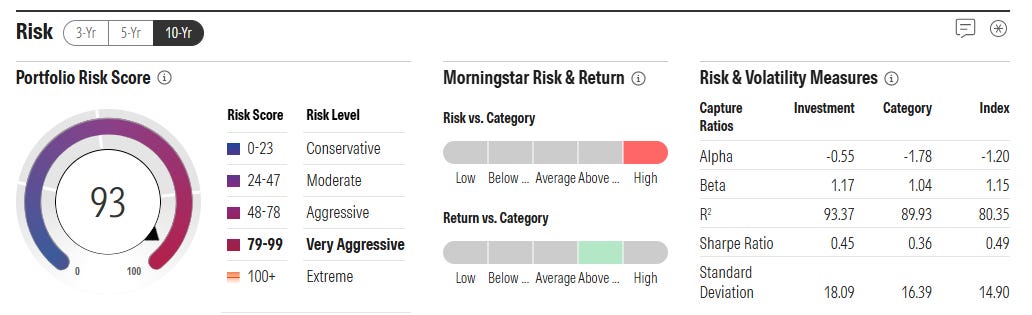

Generally speaking this fund is built to live with volatility, not avoid it. Drawdowns are part of the process when investing in eurozone small caps, and the risk metrics reflect that reality. With a beta close to 1 and volatility broadly in line with the category, risk comes from the asset class itself, not from excessive positioning. The real challenge is time: staying invested while mispricings persist and fundamentals take longer to be recognised. ⏳📉

Source: Morningstar Risk & Return.

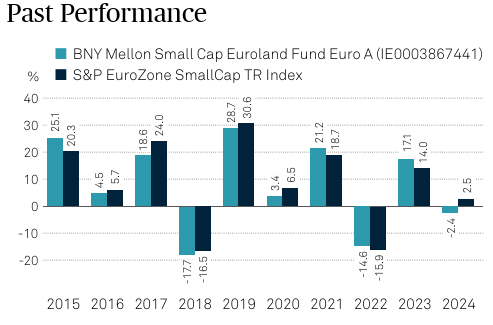

This pattern is clearly visible in the annual performance chart. Returns have been uneven year by year, with periods of underperformance aligning with broad risk-off phases rather than any deterioration in portfolio fundamentals. 📊📉

Source: BNY Mellon Investment Management. KIID data.

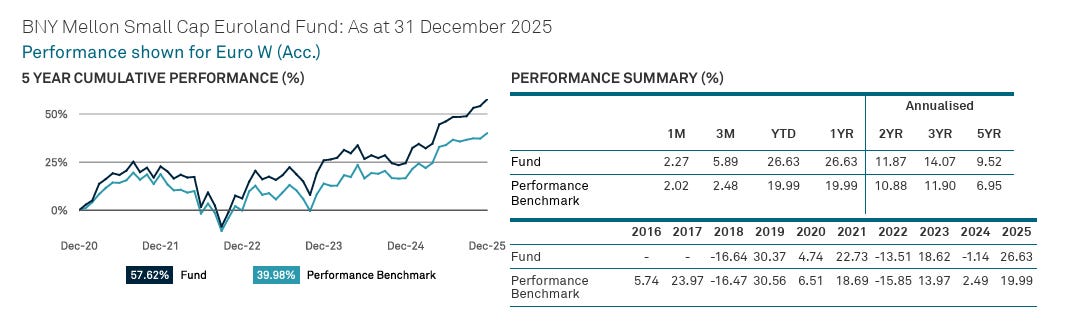

On the other hand, the cumulative performance chart captures the payoff of this approach. Over a full cycle, the fund has compounded meaningfully ahead of its benchmark, showing how periods of short-term volatility translate into long-term outperformance as earnings visibility improves and valuation gaps close. 📈🔁

Source: BNY Mellon Investment Management EMEA Limited. Portfolio data as at 31 December 2025.

The Managers Behind the Fund

The fund is managed by a dedicated team within BNY Mellon (Newton), with Tim Lucas and Paul Byrne leading portfolio decisions.

Tim Lucas

A long-standing investor within the Newton platform, Lucas brings a disciplined, bottom-up mindset focused on capital preservation first and upside second, prioritising balance sheet resilience and business durability over short-term earnings momentum.

Paul Byrne

He complements the strategy with a strong emphasis on portfolio construction and risk awareness, ensuring that conviction positions are sized appropriately and that volatility is absorbed without compromising the long-term investment thesis.

Why Look at This Fund?

This fund offers exposure to a segment of the European equity market where active management remains genuinely relevant. Eurozone small caps continue to sit outside the core focus of global capital, resulting in persistent inefficiencies that fund managers as mentioned can exploit. 🧠🏛️

Source: BNY Mellon Investment Management. KIID data.

This fund could work for or long-term investors with portfolios already concentrated in large-cap exposure,

As a satellite allocation, the strategy provides differentiated access to this opportunity set for investors willing to look beyond the most trafficked areas of the market. ⏳🎯

What do you think? Would you invest in this fund?

Do you hold this fund in your portfolio already?

Please, let us know in the comments.👇

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.