Executive Summary

Alken Fund Small Cap Europe has drawn increasing attention among long-term equity investors for one core reason:

It offers pure, high-conviction exposure to European small-cap equities, a segment where active management can still meaningfully outperform due to structural inefficiencies, limited analyst coverage, and elevated dispersion of returns we have here in Europe. 🏛️⚖️

Name: Alken Fund Small Cap Europe – Class A

ISIN: LU0524465548

Asset Manager: Alken Asset Management

Fund Structure: UCITS SICAV (Luxembourg)

Fund Type: Active Equity Fund

Asset Class: European Small-Cap Equities

Share Class Currency: EUR

Launch Date (Fund): 2009

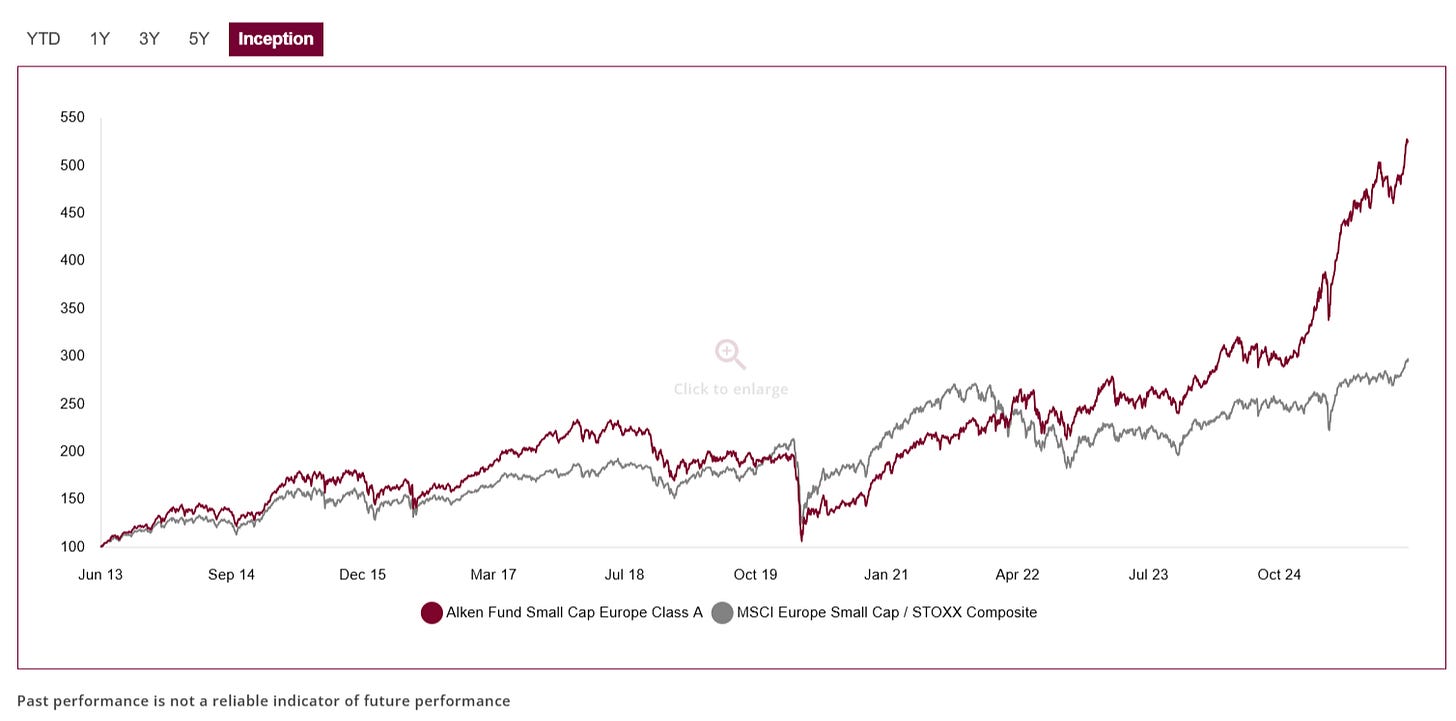

Since inception, the fund has delivered strong long-term capital appreciation, materially outperforming its benchmark, the MSCI Europe Small Cap Index, although with higher volatility and periods of pronounced relative drawdowns. 📈🏆

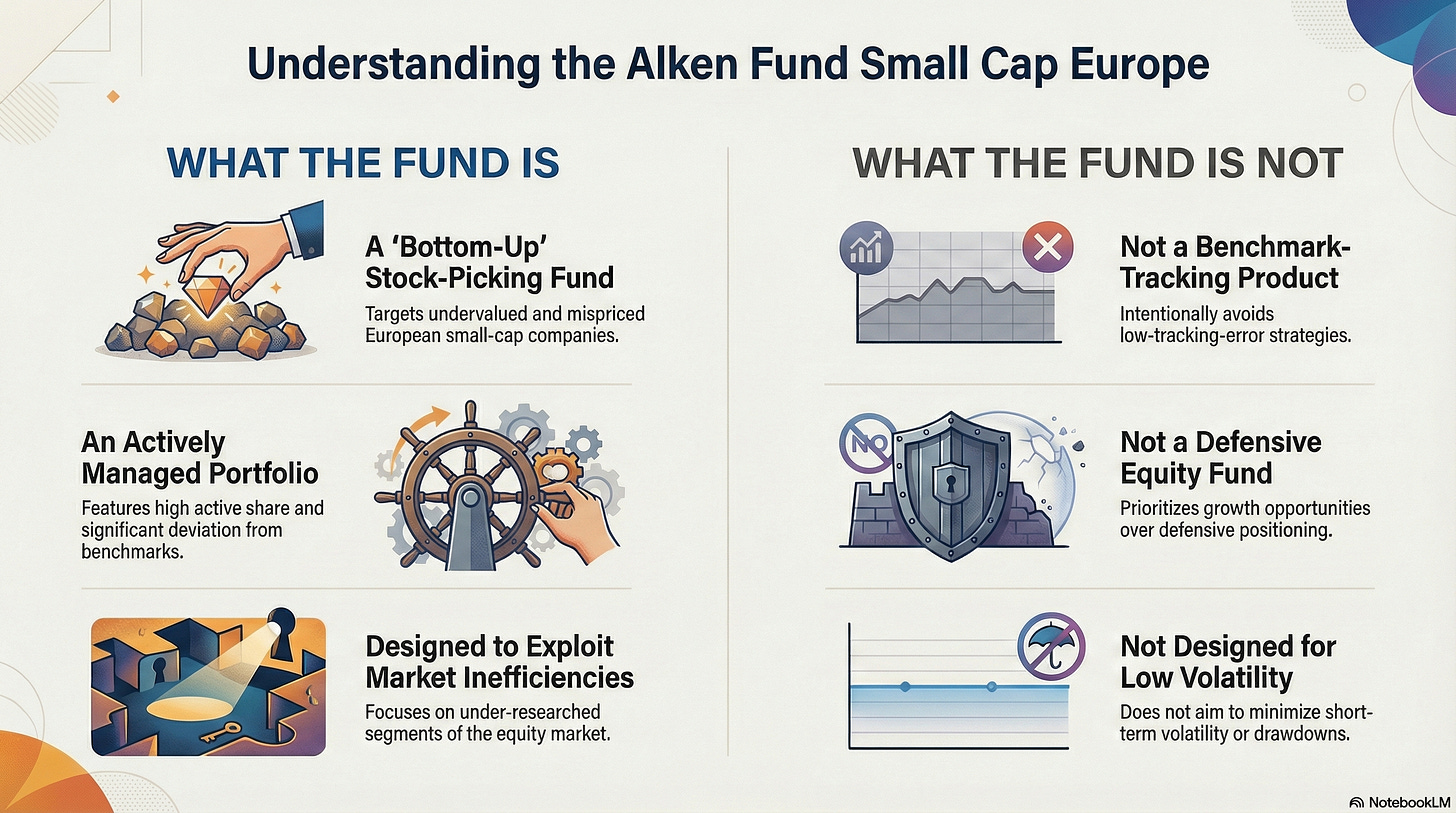

What can bring up to our mind coulbe be that it is simply a “high-risk small-cap fund.”

Nevertheless, a more accurate conclusion is that this strategy profile reflects not factor exposure or style drift, but deliberate concentration, fundamental stock selection, and a willingness to deviate sharply from the index.

In summary, Alken Fund Small Cap Europe is a pure-play European small-cap equity strategy, investing in listed companies across developed European markets with smaller market capitalisations.🧠🏛️

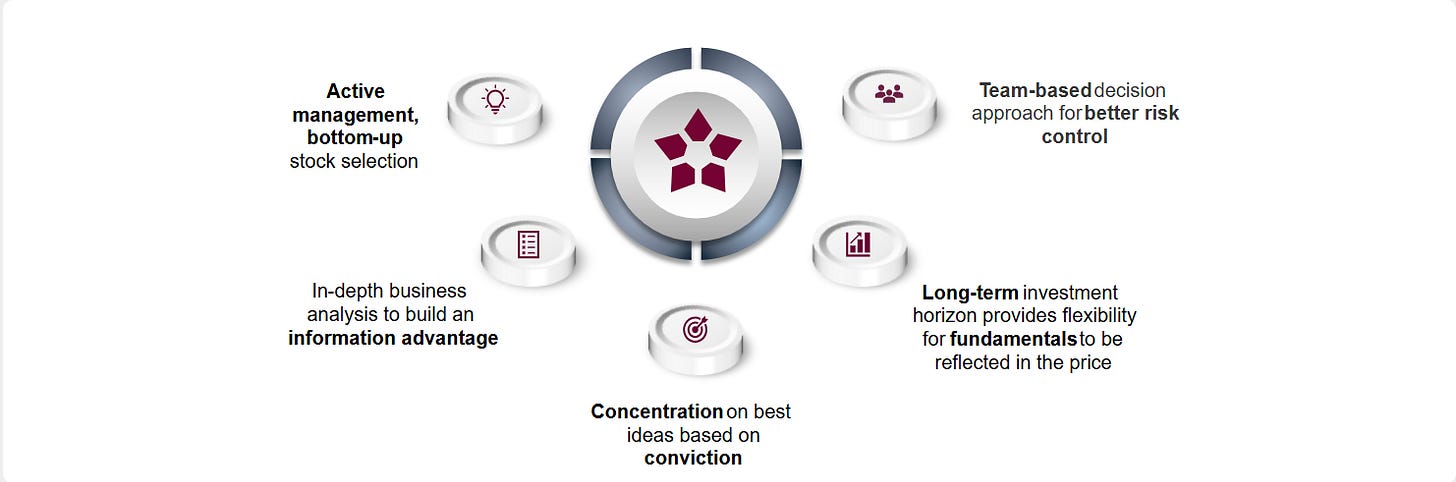

How the Strategy Works

Source: Alken Asset Management

Stock selection is driven by detailed analysis of cash-flow generation, balance sheet strength and capital allocation discipline. The strategy blends value and quality considerations, favouring businesses with resilient economics and identifiable catalysts for re-rating, while maintaining strict discipline on leverage and downside risk.

Portfolio Snapshot

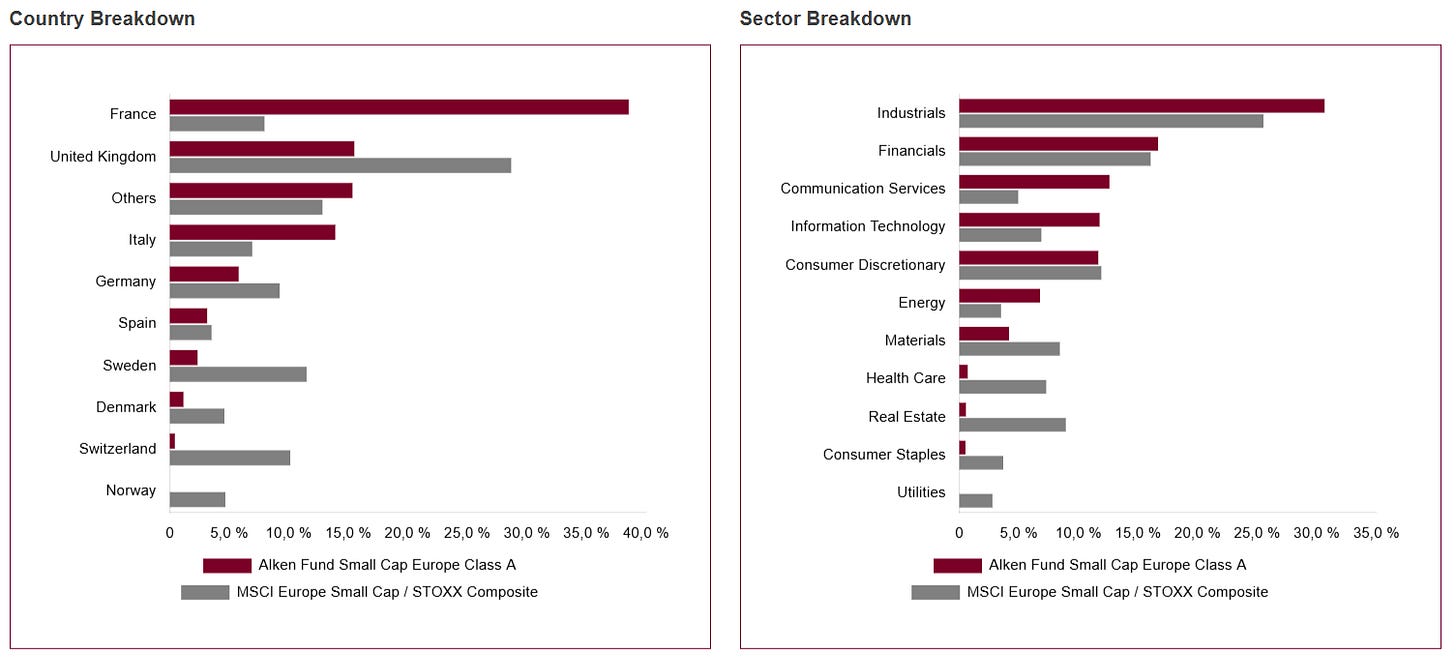

The portfolio reflects the managers’ highest-conviction ideas across small-cap equities, leading to significant country and sector deviations versus the MSCI Europe Small Cap Index.🔍📊

See the comparative below;

Source: Alken Asset Management

We can say that the geographical exposure approach focuses mainly on industrial companies and also on the financial sector, also having a slightly higher weight in these sectors compared to the index.

Risk, Performance and Expectations

Historically, the fund has generated fairly solid returns compared to its benchmark index, with performance driven by stock-specific alpha rather than market beta.

Source: Alken Asset Management

Looking ahead, returns will depend on the normalisation of European small-cap valuations and the continued execution of the managers’ fundamental approach.

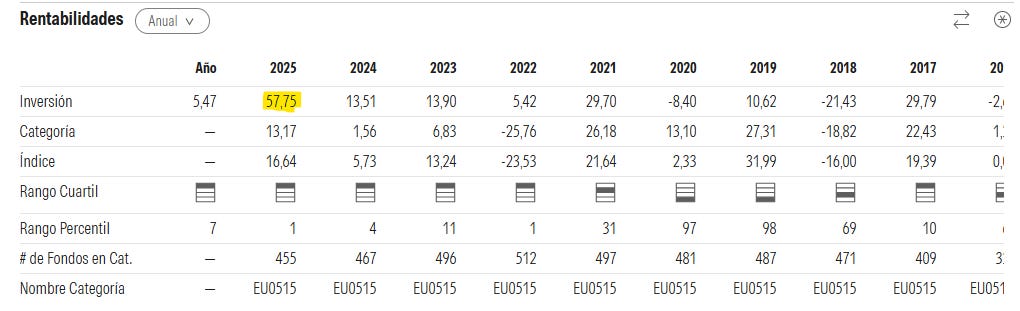

Source: Morningstar. Data in EUR

You can notice the excellent performance of the fund through the years, while short-term returns can be volatile (as expected in small-cap equities) the longer-term figures reinforce the effectiveness of the strategy’s fundamental, bottom-up investment process. The progressive normalisation of returns over longer horizons is consistent with a strategy designed to capture structural mispricings over time, rather than short-term momentum, and supports the case for viewing the fund through a long-term investment lens.📈🛡️

Disclaimer: Due to the last year’s excellente perfomance, subscription terms and availability of this fund may be subject to restrictions, including potential soft-close measures. You should check this directly with the fund manager or the official distributor before making any investment decision.

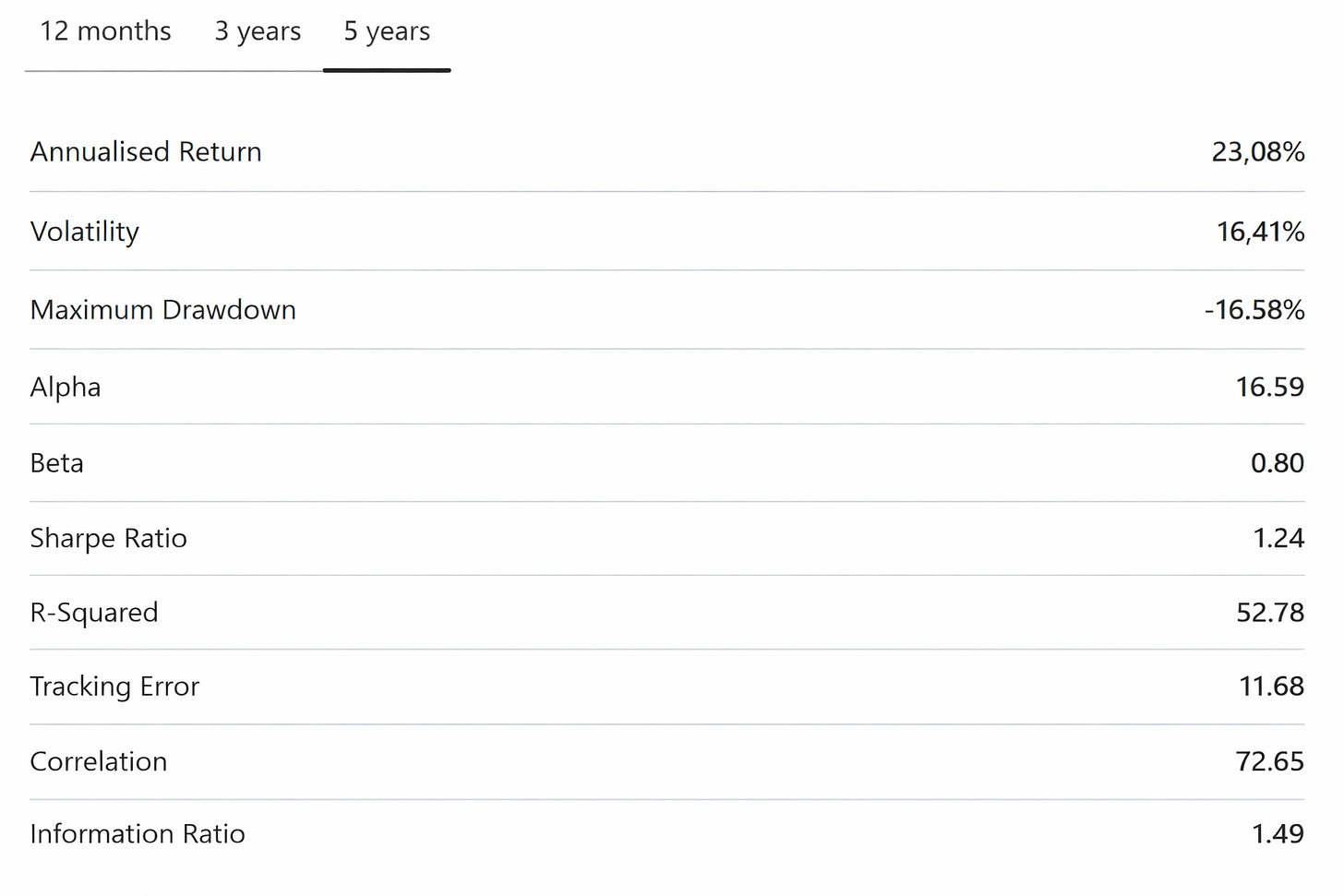

Source: Finect. Data in EUR

On the other hand, this set of metrics highlights the quality of returns generated by the strategy over the last five years. The combination of a high annualised return, moderate volatility, and a Sharpe ratio above 1 points to strong risk-adjusted performance. A beta below 1 suggests lower sensitivity to market movements, while the elevated alpha and information ratio confirm that returns have been primarily driven by active stock selection rather than market exposure. 🧭🌍

The Manager Behind the Fund

The fund is co-managed by Nicolas Walewski and Marc Festa, combining strategic oversight with hands-on portfolio execution:

Nicolas Walewski, Founder and Chief Investment Officer of Alken Asset Management, is the historical architect of the firm’s investment philosophy and has been instrumental in shaping its high-conviction, fundamentally driven approach to European equities.

Marc Festa, a senior portfolio manager with experience in European equity markets dating back to 2005, is responsible for the day-to-day implementation of the Small Cap strategy, leading stock selection and portfolio construction

Why Look at This Fund?

Alken Fund Small Cap Europe – Class A offers exposure to a segment of the equity market where active management remains highly relevant. As a satellite allocation, the fund provides differentiated exposure to European small caps for investors willing to accept volatility in pursuit of sustained alpha.⏳🎯

Who is this fund for? The strategy it would be suited for investors with a long-term horizon who can tolerate interim drawdowns in exchange for differentiated alpha potential.

What do you think? Would you invest in this fund?

Do you hold this fund in your portfolio already?

Please, let us know in the comments.👇

Finally, I leave you here with another in-depth and enlightening analysis of this fund by Manuel Ritsch of the “Inversión Sensata Podcast”.

Manuel Ritsch | @manuelritsch

⚠️ DISCLAIMER | LEGAL ADVICE⚠️

Magno investments is not an entity authorised or supervised by any financial authority and does not provide investment services or regulated financial advice.

All material provided (articles, presentations, theses, ideas, opinions and analyses) are for informational and educational purposes only and does not constitute a recommendation to buy, sell or hold financial instruments, nor does it constitute personalised advice

Magno Investments Research are not responsible for the use made of this information or the veracity of its sources.

Magno Investments and/or its writer and contributors may hold, directly or indirectly, positions in the securities mentioned in the content. These positions may be changed at any time without prior notice.

Before investing in a real account, it is necessary to have the appropriate training or otherwise delegate this task to a professional duly authorized to do it. Magno Investments is not responsible for the use that members make of the information or for any losses arising from their investments.

Thanks for the mention!